Your cart is currently empty!

Hotbit, Take Profit, Supply and Demand

“Taking Control of Your Crypto Portfolio: The Role of Supply and Demand in Timing Your Investment”

The world of cryptocurrencies has become increasingly popular over the past decade, with many people investing their savings or trading stocks in digital currencies like Bitcoin (BTC) and Ethereum (ETH). However, despite its growing popularity, investing in cryptocurrencies can be a daunting task. One key factor that investors often overlook is supply and demand.

Understanding Supply and Demand

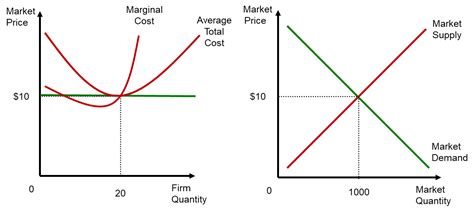

Supply and demand is a fundamental concept in economics, where the interaction of buyers and sellers determines the price of a good or service at any given time. In the context of cryptocurrencies, supply refers to the total amount of coins or tokens available for sale in the market, while demand refers to the number of investors willing to purchase these assets.

The Role of Supply in Cryptocurrencies

One of the most important factors that affects cryptocurrency prices is overall supply and demand. When the supply of a particular coin increases, it can cause the price to drop, as there are more coins available for sale at any given time. Conversely, when the demand for a certain cryptocurrency increases, it can cause its price to rise.

Take Bitcoin, for example. As of 2021, the total supply of BTC is capped at 21 million, and new cryptocurrencies are introduced through the process of mining. Historically, the supply of BTC has increased at a rate that exceeds demand, leading to periods where prices have been driven down by excess supply.

The Role of Demand in Cryptocurrencies

Demand can also play a significant role in determining cryptocurrency prices. When investors become eager to buy coins or tokens because of their perceived value or growth potential, it can lead to an increase in price. Conversely, when demand decreases or becomes less enthusiastic, it can lead to a decrease in price.

Take Profit and Timing

A common strategy employed by traders is profit-taking, where they sell their assets at a predetermined price to lock in profits before prices fluctuate further. However, this approach requires a thorough understanding of the market and its underlying dynamics, including supply and demand.

Hotbit: A Leading Platform for Buying and Selling Cryptocurrencies

Hotbit, a popular exchange for buying and selling cryptocurrencies, has recently come under the spotlight. With a user-friendly interface and competitive fees, Hotbit offers a range of services including trading pairs, margin trading, and staking.

Why Take Profit with Hotbit?

Hotbit’s Take Profit feature allows traders to lock in the prices of their assets at any time, giving them complete control over their portfolio. This feature is especially useful for experienced traders who have developed an understanding of market dynamics and can accurately predict price movements.

How to Use Supply and Demand to Your Advantage

While taking profits with Hotbit can be a valuable strategy, it is essential to understand the underlying forces of supply and demand that drive cryptocurrency prices. By combining this knowledge with technical analysis, traders can make more informed decisions and increase their chances of success in the market.

In conclusion, understanding supply and demand is essential for investors looking to succeed in the world of cryptocurrencies. By recognizing how these factors impact price movements, traders can take control of their portfolios and make more informed investment decisions. With Hotbit at its core, this knowledge has become increasingly accessible, allowing individuals to harness the power of cryptocurrency investing.

Disclaimer: This article is provided for informational purposes only and should not be considered investment advice.

Leave a Reply