Your cart is currently empty!

Cross-Platform Trading, Binance Coin (BNB), Futures

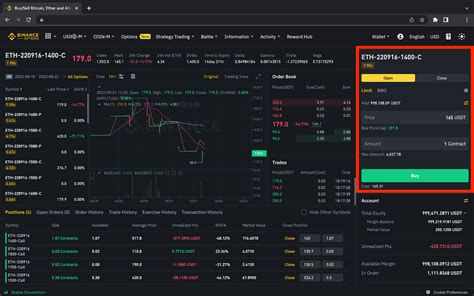

“Cross-Platform Cryptocurrency Trading on Binance Coin (BNB) and Beyond: The Future of Futures in Crypto Market”

The world of cryptocurrency trading is rapidly evolving, with new opportunities emerging every day. One key area of growth is cross-platform trading, where users can seamlessly move their cryptocurrencies across different exchanges without sacrificing significant capital gains or losing control over their assets. Today, we’ll delve into the world of Binance Coin (BNB), explore its potential applications in cross-platform trading, and discuss how it’s playing a crucial role in shaping the future of cryptocurrency futures.

What is Cross-Platform Trading?

Cross-platform trading refers to the ability of users to trade cryptocurrencies across multiple exchanges without the need for physical currency or account changes. This means that users can buy, sell, and hold different cryptocurrencies on various platforms, creating a single user interface (UI) experience. While this concept may seem complex at first glance, cross-platform trading has been gaining momentum in recent years.

Binance Coin (BNB): The DeFi Champion

The Binance ecosystem is built around the Binance Coin (BNB), the native cryptocurrency of Binance Exchange, one of the largest and most popular exchanges globally. As a token, BNB has several key benefits:

- Decentralized Governance: BNB holders have a say in the development and direction of the Binance platform through its DeFi-focused governance model.

- Faster Transaction Times: With cross-platform trading capabilities, users can quickly buy, sell, and hold BNB on various exchanges without waiting for long confirmation periods or high fees.

- Diversification Opportunities: As a widely traded token, BNB offers numerous investment opportunities across different asset classes, including cryptocurrencies, tokens, and commodities.

Cross-Platform Trading with Binance

Binance’s cross-platform trading capabilities allow users to access various exchanges, including:

- Binance US (BNBBUSDT): Trade Bitcoin on the popular US-based exchange.

- Binance Germany (BNBBERT): Trade cryptocurrencies on the German-focused exchange.

- Binance Singapore (BNBSGDUSD)

: Trade BNB and other cryptocurrencies against SGD.

These partnerships enable users to trade on multiple platforms, reducing trading costs and increasing market visibility. Additionally, Binance’s robust API provides developers with a seamless experience for building their own applications and services.

Futures Trading in Cryptocurrency Market

Cryptocurrency futures are a relatively new concept in the cryptocurrency space. Futures contracts allow traders to hedge against potential price movements or speculate on future market trends. In recent years, crypto futures have gained significant attention, with several exchanges launching their own platforms.

BNB’s role in the crypto futures market is multifaceted:

- Funding Liquidity

: As a widely traded token, BNB serves as a liquidity provider for various cryptocurrency futures contracts.

- Tokenized Exchanges: Binance has launched its own futures platform on the Binance Chain, allowing users to trade on their own terms.

The integration of cross-platform trading and BNB in the crypto market is expected to drive innovation and growth in the following ways:

- Increased Accessibility: Users will be able to access a broader range of exchanges, reducing transaction costs and increasing market visibility.

- Diversification Opportunities: With BNB’s inclusion in various cryptocurrency futures contracts, users can diversify their portfolios across different asset classes.

- Improved User Experience: Seamless cross-platform trading capabilities will enhance the overall user experience, making it easier for traders to navigate complex markets.

Leave a Reply