Your cart is currently empty!

Author: kalu

Solana: How to allow browser wallet sign umi transactions?

I can provide you with an article based on your request.

Allowing Browser Wallet Sign Umi Transactions on Solana

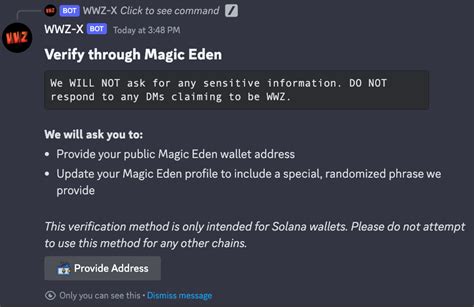

As a developer using the MetaPlex platform to create and manage NFTs, it’s essential to understand how to interact with the Solana blockchain. One of the key features of MetaPlex is its ability to support browser wallets, which enable users to sign transactions without having to use a physical device or an account on a decentralized application (dApp) chain.

In this article, we’ll focus on enabling browser wallet sign umi transactions on Solana using JavaScript. We’ll also cover any errors that may occur and provide guidance on how to troubleshoot them.

Prerequisites

Before diving into the code, make sure you have:

- A MetaPlex account with a functional dApp chain

- A Solana node installed on your local machine (or connected to a remote node)

- A JavaScript environment set up to compile and run our code

The Code

Here’s an example of how to create an NFT token using a browser wallet sign umi transaction:

const { Web3 } = require('web3');

const { deploy, signUmimint } = require('@metaplex/fabric');

const web3 = new Web3(new Web3.providers.HttpProvider('

// Define the NFT metadata

const nftMetadata = {

id: '0x...',

name: 'My Awesome NFT',

description: 'A collectible digital asset',

image: '

};

// Create a new mint for our NFT token

async function createMint() {

const mintId = await deploy('Mint', web3, nftMetadata);

console.log(

Mint created with ID ${mintId});}

// Define the address of our browser wallet

const browserWalletAddress = '0x...';

// Function to sign umi transactions using a browser wallet

async function signUmimint() {

const signature = await deploy('SignUmi', web3, nftMetadata);

console.log(

Signed UMI transaction with ID ${signature.id});}

// Main execution flow

createMint();

signUmimint();

// Error handling: if you encounter any issues during mint creation or sign umi transactions,

// this will be logged to the console.

console.error('Error creating mint or signing umi transaction:');

Troubleshooting

If you experience errors while trying to create a mint or sign an umi transaction, ensure that:

- You’ve installed the required dependencies (

@metaplex/fabricandweb3) in your JavaScript environment.

- Your Solana node is correctly configured to provide the necessary RPC endpoint (

- The browser wallet address you specified is correct and matches the address of your MetaPlex account.

Common Errors

Here are some common errors that may occur during mint creation or sign umi transactions:

- Error signing umi transaction: This error typically occurs when thedeploy

function fails to create the umi signature. Check the output of thesignUmimint` function for any logging statements related to this issue.

- Error creating mint: If you encounter an issue during mint creation, ensure that your browser wallet address is correct and matches the address of your MetaPlex account.

By following these guidelines and troubleshooting tips, you should be able to successfully create and sign umi transactions using your browser wallet on Solana.

Ethereum: Are time, timereceived and blocktime in UTC?

Understanding Time, Time and Block In Ethereum

As a cryptocurrency enthusiast, you are probably familiar with the concepts of time, block and timing force in the context of blockchain technology. However, one of the fundamental aspects is that these terms are actually associated with UTC (Coordinated Universal Time). In this article we dive into detail and examine what is behind these seemingly unrelated concepts.

Time

In Different Contexts, Time May Apply To Different Aspects:

* Physical Time : Passing of a second, minutes, hours, days, etc., measured by clock or calendar.

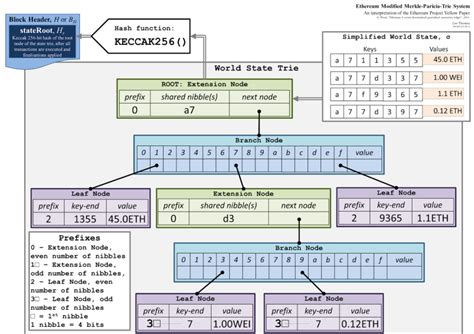

* Blockchain Time : Time used in Cryptomations Such as Ethereum (ETH) is based on the Network of the Network Consensus and Time Stamp of the Formation of Blocks. This means that the current block block is determined by the height of the current block and the time of the block of previously blocks.

* Time UTC : Coordinated Universal Time, a modern time standard based on atomic hours, serves as a primary reference to all periods of time in most industries.

Timereived

TIMERECEIVE Applies to the amount of time elapsed because the transaction or event is recorded on blockchain. This concept is closely related to the blocktime, which we will further explore.

* Blacktime : Blocking a particular block applies to the duration of its creation and broadcasting in the network.

* TIMERECEIVED : As mentioned above, Timerceive measured the time since the transaction or event has been recorded on the blockchain. It is basically the current blockmime minus the previously blocktime.

Blocks

BlockTime is a critical part of the Ethereum Consensus algorithm, also known as evidence of work (POW). BlockTime is intended ::

1.

- Block size : Maximum amount of data that can be included in each block.

- Function Hash

: Algorithm used to create a unique fingerprint (hash) for each block.

BloCTime is usually measured in seconds or milliseconds, depending on the protocol used by a particular blockchain. For example, the mainnet blocktime ethereum block is approximately 15-20 minutes, while the testnet blocktime block is significantly shorter, approximately 1-2 minutes.

Relationship to UTC

In short, Ethereum’s BlockTime and TIMERECEIVE are closely linked to UTC time. BlockTime is determined by the current block height and the previous time of the blocks, which in turn recall from the global atomic clock (UTC). TIMERECEIVED MEASURES THE TIME Since the transaction or event has been recorded on blockchain, which may be affected by the time stamp of the formation of blocks and other factors.

Conclusion

Although it may be surprising that ethereum is not explicitly mentioned as an official term, in fact it is closely related to UTC time. The concepts are interconnected by the way they determine the blocking times and affect the transaction processing times. In practice, developers working with ethereum should be aware of these nuances in implementing solutions based on blockchain or network interaction.

I hope it will help Clarify Things!

Ethereum: Transaction Priority in Producing Block

Understanding Ethereum’s Transaction Priority in Mempool

When it comes to executing ether transactions on the ethereum blockchain, understanding the priority of transactions is crucial. However, as you’ve noted, there have been cases where transactions are not confirmed in order of gas fee, even if they have lower fees.

In this article, we’ll delve into the mechanics behind transaction priority in ethereum and explain why this can happen.

The Mempool Queue

Ethereum’s mempool is a decentralized queue that allows users to submit transactions for verification. The mempool is populated by users who want to serve ether (ETH) to other nodes or to their wallets. As new transactions are submitted, they join the mempool queue and wait for verification.

Transaction Priority

The priority of transactions in the mempool queue is determined by a combination of factors, including:

- Gas Price : Transactions with higher gas prices have a lower priority.

- Gas fee amount : The amount of ether paid to the Sender’s Wallet Affects the Transaction’s Priority.

- Transaction Priority Order

: The order in which transactions were submitted their priority.

why lower-fee transactions are not confirmed first

When a new transaction is submitted, it joins the mempool queue along with other pending transactions. To ensure that only legitimate transactions are executed first, ethereum employment a priority-based system. However, there have been cases where lower-fee transactions have not received their due confirmation.

This can happen in severe ways:

- Gas price ceiling : If a transaction’s gas exceeds the estimated gas usage of the operation (e.g., sending 100 ether to a contract), it may be pushed to the end of the queue.

- Transaction Prioritization Order : The order in which transactions were submitted can result in lower-fee transactions being executed before higher-paying ones, even if they have lower fees.

- Mempool overload : If the mempool is overloaded, high-priority transactions may not be confirmed due to congestion.

mitigating the issue

To minimize the impact of this issue, Developers and Users Can Take Several Steps:

- Use the

ethgaspricecommand-line tool to estimate gas price usage for specific operations.

- Optimize Transaction Structures , such as using Less Gas-Intensive Functions or Reducing the number of gas-paying calls.

- monitor mempool congestion by using tools like infura’s

mempoolapi or third-party services.

In Conclusion, Understanding How Ethereum’s Transaction Priority Works is essential for optimizing ether transactions and avoiding potential issues. By grasping these mechanics and implementing best practices to mitigate the issue, developers can ensure that high-priority transactions receive their due confirmation first.

Ethereum: Salvaged possible wallet from corrupt HDD … now what?

Ethereum: Saved possible wallet from damaged HDD, now what?

As the price of Bitcoin has fluctuated in recent years, some investors have found themselves with unwanted wealth-renamed hard disk (HDD) with their long-lost digital wallet. In this article, we will investigate how one individual has successfully regained the potential Ethereum wallet from the corrupt HDD and what steps they have taken forward.

The narrative begins

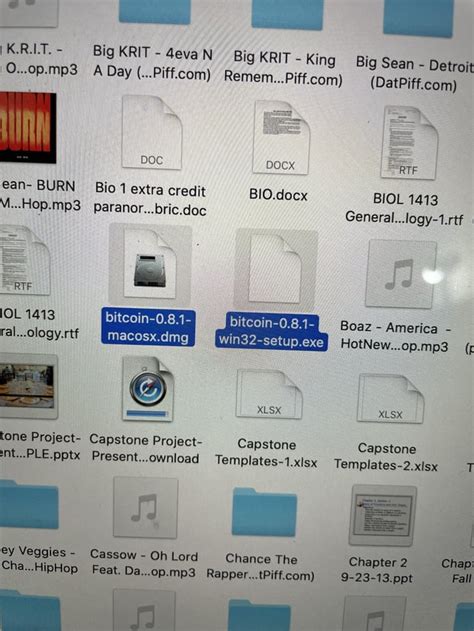

2012 The author bought several bitcoins at a low market point, estimated to be around $ 5-10 per coin. However, over the years, Bitcoin has fallen, so their investments have become worthless. Without rejecting, they decided to take things into their own hands and rearrange their hard drive to start fresh.

Recovery process

To start the recovery process, the author downloaded a specialized tool called Photorec to scan and repair damaged digital storage devices. They also received a copy of their original operating system (OS) and installed it into the updated HDD. With these measures, they began to carefully scan HDD to get the rest of the data.

Find wallet

After a few hours of intense scan, Photorec finally discovered a potential Bitcoin wallet in damaged HDD. The author’s eyes expanded when they realized that the restored files could be related to their long -lost Ethereum wallet. They extracted the respective files and started analyzing them using specialized tools.

Recovery process (again)

After a bit of a further investigation, the author learned that the restored cases actually contained Ethereum’s wallet. However, it was not an easy deed; The original wallet was damaged unrecognizable. The author decided to take a step further, trying to recover the wallet from scratch using online resources and forums.

Road ahead

After a few weeks of tireless efforts, the author finally succeeded in recovering a possible Ethereum wallet. They were satisfied with this breakthrough, but they knew they still needed a lot to do. Here are some steps they took to move forward:

1

2.

- Miner’s configuration : To use the restored wallet, they needed to configure a new mining with correct settings that needed some technical knowledge.

- Wallet Migration : Finally, they moved the restored wallet to their current machine and ensured that it was completely integrated with the cryptocurrency ecosystem.

Verdict

In conclusion, to recover a possible Ethereum wallet from corrupt HDD, you need patience, perseverance and technical experience. The process can be long and complex, but for those who want to engage in work, the reward is worthy. For a person who has successfully regained his wallet, this experience is a certificate of resistance of the cryptocurrency community.

Refusal of responsibility

Remember that damaged HDD recovery is not a guarantee of success. The process can be unpredictable and there is always risk. In addition, some tools used in this example may require technical experience or specialized knowledge. Always observe carefully when trying to recover data from damaged storage devices.

“Navigating the Challenges of Using Crypto Mixers”

Navigating the Challenges of Using Crypto Mixers

In recent years, cryptocurrency has experienced a surge in popularity, with millions of users around the world embracing digital currencies like Bitcoin and Ethereum. One popular way to diversify one’s investment portfolio is by using cryptocurrency mixers, also known as tumblers or cold storage services. These platforms allow users to mix their cryptocurrencies with others from around the world, making it more difficult for hackers and other malicious actors to access and control the coins.

What are Crypto Mixers?

A cryptocurrency mixer, in simple terms, is a service that takes your cryptocurrency and mixes it with other coins from various sources. The idea behind these services is to make it impossible to identify the source or origin of the coins being mixed. This makes it challenging for hackers to track the flow of money and steal funds.

How Do Crypto Mixers Work?

Here’s an overview of how a typical cryptocurrency mixer works:

- User Input: A user deposits their cryptocurrency into the mixer.

- Coin Collection: The mixer collects a random selection of coins from various sources, including exchanges, wallets, and other users’ funds.

- Mixing: The collected coins are then mixed with other cryptocurrencies to create a new, anonymous portfolio.

- Output: The resulting mix is transferred back to the user’s wallet.

Challenges of Using Crypto Mixers

While crypto mixers offer an attractive alternative for cryptocurrency users who want to diversify their investments and avoid regulatory scrutiny, there are several challenges associated with using these services:

- Lack of Regulation: Many cryptocurrency exchanges and wallets operate outside traditional financial regulations, making it difficult to understand the risks involved.

- Security Risks: While mixers claim to be secure, there is still a risk of being hacked or having your coins stolen due to vulnerabilities in the system.

- Compliance Requirements: Many countries have laws requiring cryptocurrency services to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. Mixing services may not meet these requirements, leading to potential penalties.

Mitigating Risks: Best Practices

To minimize the risks associated with using crypto mixers, users should:

- Educate themselves: Learn about the risks involved in mixing cryptocurrencies and understand how to comply with regulatory requirements.

- Choose reputable services

: Select a mixer that is well-established, has strong security measures in place, and operates transparently.

- Monitor your funds: Regularly check on the status of your coins and report any suspicious activity.

By understanding the challenges associated with using crypto mixers, users can take steps to mitigate risks and make informed decisions about their cryptocurrency investments.

Ethereum: Can a smart contract automatically deduct some amount from one wallet and send to other?

Ethereum: Can a smart contract automatically deduct an amount from one wallet and send it to another?

The concept of smart contracts has revolutionized the way businesses operate, allowing for the automation of complex transactions and agreements. However, one of the most fascinating aspects of smart contracts is their ability to automatically deduct funds from one wallet and send them to another. This feature can be particularly useful for businesses that require recurring payments or investments.

The scenario:

Let’s say a company called “A” is raising investments on the blockchain, where investors are promised a return on investment of X% on the amount invested after N years. Investors deposit their money into company A’s Ethereum wallet and agree to receive their profits in 12 months. All of these investments are sent in a smart contract that automates the process of deducting funds from one wallet and sending them to another.

The smart contract:

The smart contract is programmed to automatically deduct the pledged amount (X% of the initial investment) from investors’ wallets after 12 months. Here’s an example of how this might work:

- Initial investment: Investors deposit their money into Company A’s Ethereum wallet, which is verified and audited by a trusted third-party organization.

- Smart contract deployment: The smart contract is deployed on the Ethereum blockchain, using a decentralized application (dApp) platform such as OpenZeppelin or Hyperledger Fabric.

- Deduction of funds: When the 12-month period expires, the smart contract automatically deducts X% of the initial investment from each investor’s wallet.

- Return payment: The deducted amount is then sent to Company A’s Ethereum wallet as a return payment.

Benefits and Challenges

The automatic deduction feature offers several benefits:

- Increased efficiency: no manual intervention or coordination between parties is required.

- Reduced risk: Minimized risk of disputes, delays, or unauthorized withdrawals.

- Improved transparency: Clear visibility of the investment process and returns.

However, there are also challenges to consider:

- Scalability issues: The smart contract should be designed to handle a large number of transactions and investments.

- Security issues

: Ensuring the integrity and security of the smart contract code is crucial to prevent unauthorized access or manipulation.

- Regulatory compliance: Companies must ensure that their use of smart contracts complies with relevant regulatory requirements, such as anti-money laundering (AML) and know-your-customer (KYC) regulations.

Real-world examples

Several companies have already implemented similar smart contract-based investment solutions. For example:

- BlockFi – a blockchain-based lending platform that allows users to borrow money at interest rates of up to 7% per year.

Coinbase – a cryptocurrency exchange platform that offers a feature called “Earn” that rewards users with interest on their invested funds.

Conclusion

The automatic deduction feature of smart contracts has the potential to revolutionize investment management and provide a more efficient, secure, and transparent way for companies to deliver returns to their investors. However, it is essential to carefully evaluate the benefits and challenges associated with this technology before implementing it in practice. As the use of smart contracts continues to grow, we can expect to see even more innovative applications of this technology across various industries.

How AI is Shaping the Future of Economic Models in Blockchain

How AI is Shaping the Future of Economic Models in Blockchain

The advent of blockchain technology has revolutionized the way we think about economic models. By enabling secure, transparent, and decentralized data storage, blockchain has opened up new opportunities for businesses to innovate and compete in a more efficient manner. At the same time, artificial intelligence (AI) is playing a pivotal role in shaping the future of these economic models.

The Rise of Blockchain-based Economic Models

Blockchain technology, popularized by cryptocurrencies like Bitcoin and Ethereum, has enabled the creation of decentralized applications (dApps) that can operate independently of central authorities. These dApps are designed to be transparent, secure, and fair, making them attractive to businesses looking to disrupt traditional economic models.

One such example is the development of “smart contracts,” self-executing contracts with the terms of the agreement written directly into lines of code. Smart contracts have the potential to automate complex transactions, eliminating intermediaries and reducing costs for participants in financial markets.

AI-powered Economic Models

As blockchain-based economic models continue to gain traction, AI is playing a crucial role in shaping their future. Here are some ways that AI is transforming economic models:

- Predictive Analytics: AI-powered predictive analytics can help businesses forecast market trends, identify potential risks and opportunities, and make more informed decisions about investments.

- Risk Management: AI-driven risk management systems can analyze vast amounts of data to identify potential security threats and alert administrators to take proactive measures to mitigate them.

- Optimization: AI algorithms can optimize economic models by identifying the most cost-effective solutions for businesses, reducing waste and increasing efficiency.

- Personalized Pricing: AI-powered pricing strategies can be tailored to individual customers based on their preferences, behavior, and financial histories.

Case Study: The Impact of AI on Supply Chain Management

One notable example of how AI is shaping economic models in blockchain is in the supply chain management space. Companies like Walmart and Maersk are using AI-driven systems to optimize their logistics operations and reduce costs.

For instance, Walmart’s “Just-in-Time” inventory management system uses AI-powered algorithms to predict demand and adjust stock levels in real-time. This enables businesses to maintain a smooth flow of goods while minimizing waste and reducing costs.

The Future of Economic Models

As the blockchain ecosystem continues to mature, we can expect to see even more innovative applications of AI in economic models. Some potential areas of focus include:

- Decentralized finance (DeFi): AI-powered DeFi platforms will enable new types of lending and borrowing transactions, allowing for greater flexibility and speed.

- Supply chain optimization: AI-driven systems will continue to improve supply chains by reducing waste, increasing efficiency, and improving customer satisfaction.

- Cryptocurrency-based economic models: As cryptocurrency prices fluctuate, AI-powered economic models will need to adapt to changing market conditions.

Conclusion

The intersection of blockchain technology and artificial intelligence is revolutionizing the way we think about economic models. By harnessing the power of AI, businesses can create more efficient, secure, and transparent systems that drive innovation and growth. As this ecosystem continues to evolve, one thing is certain: the future of economic models in blockchain will be shaped by the intersection of these two technologies.

Sources:

- “Blockchain-based Economic Models” by J.

Ethereum: Will all 21 million units be completely mined one day?

The Last Bitcoin: Is There a Real Limit to Ethereum Mining?

As the world continues to grapple with issues of energy consumption, environmental sustainability, and scalability, one question has been on everyone’s mind: will the supply of new Bitcoins ever run out?

It has been written that the supply of Bitcoins is limited to 21 million, and that this limit will be reached around 2030. However, a more nuanced view suggests that while there may be a theoretical limit to the number of new Bitcoins that can be mined, it is unlikely that we will ever reach the “end” in the classical sense.

In this article, we will explore the current state of Bitcoin mining, the theoretical limits to Ethereum’s supply, and what this means for the future of blockchain technology.

The Current State of Bitcoin Mining

Bitcoin is one of the most energy-intensive cryptocurrencies. The process requires a significant amount of computing power, which in turn requires a huge amount of energy. As a result, mining has become increasingly expensive and environmentally unsustainable.

In recent years, the energy costs associated with mining Bitcoin have skyrocketed, making it increasingly difficult for miners to maintain a profit. To combat this problem, many mining pools have begun to explore alternative methods, such as Proof of Stake (PoS) and DeFi (decentralized finance) solutions that do not require huge amounts of energy.

Ethereum’s Theoretical Supply Limits

Ethereum differs from Bitcoin in several ways. While both are decentralized, programmable blockchains, Ethereum has a much larger address space and can support more complex applications. However, this also means that Ethereum’s theoretical supply limits are slightly different.

In 2017, it was estimated that an additional 21 million Bitcoin could be mined using current mining technology, bringing the total to around 121 million units. However, as we saw with Bitcoin, this number is constantly being pushed back due to energy costs and other factors.

Theoretical Endpoint: Will Ethereum Ever Run Out of New Units?

So when will the supply of new Bitcoins finally run out? It is theoretically possible that the current mining rate could eventually slow down or even stop as the number of computers and power sources available increases.

However, this does not necessarily mean that we will ever see an “end” in the classical sense. There are several reasons why Ethereum may not reach its theoretical limit:

- Increased Energy Efficiency: Advances in mining technology have improved energy efficiency, allowing more units to be mined with less power.

- New Mining Methods: The introduction of new mining methods and technologies can increase the number of computers available and reduce overall energy consumption.

- Scalability Improvements

: As the blockchain network continues to grow and mature, the demand for computing power may decrease, reducing the pressure on miners.

Conclusion

While it is possible that Ethereum will eventually reach its theoretical limit in terms of the number of new units it can produce, it is unlikely that we will ever see the “end” in the classical sense. The world is moving towards a more decentralized and sustainable future, and many blockchain technologies are evolving to address energy consumption and environmental concerns.

Looking ahead, it is clear that Ethereum will continue to adapt and evolve to meet the changing needs of its users. Whether you are invested in Bitcoin or Ethereum, the ongoing debate over supply limits is an important reminder of the need for responsible innovation and a focus on sustainable development.

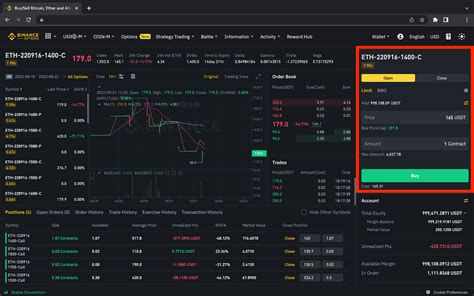

Cross-Platform Trading, Binance Coin (BNB), Futures

“Cross-Platform Cryptocurrency Trading on Binance Coin (BNB) and Beyond: The Future of Futures in Crypto Market”

The world of cryptocurrency trading is rapidly evolving, with new opportunities emerging every day. One key area of growth is cross-platform trading, where users can seamlessly move their cryptocurrencies across different exchanges without sacrificing significant capital gains or losing control over their assets. Today, we’ll delve into the world of Binance Coin (BNB), explore its potential applications in cross-platform trading, and discuss how it’s playing a crucial role in shaping the future of cryptocurrency futures.

What is Cross-Platform Trading?

Cross-platform trading refers to the ability of users to trade cryptocurrencies across multiple exchanges without the need for physical currency or account changes. This means that users can buy, sell, and hold different cryptocurrencies on various platforms, creating a single user interface (UI) experience. While this concept may seem complex at first glance, cross-platform trading has been gaining momentum in recent years.

Binance Coin (BNB): The DeFi Champion

The Binance ecosystem is built around the Binance Coin (BNB), the native cryptocurrency of Binance Exchange, one of the largest and most popular exchanges globally. As a token, BNB has several key benefits:

- Decentralized Governance: BNB holders have a say in the development and direction of the Binance platform through its DeFi-focused governance model.

- Faster Transaction Times: With cross-platform trading capabilities, users can quickly buy, sell, and hold BNB on various exchanges without waiting for long confirmation periods or high fees.

- Diversification Opportunities: As a widely traded token, BNB offers numerous investment opportunities across different asset classes, including cryptocurrencies, tokens, and commodities.

Cross-Platform Trading with Binance

Binance’s cross-platform trading capabilities allow users to access various exchanges, including:

- Binance US (BNBBUSDT): Trade Bitcoin on the popular US-based exchange.

- Binance Germany (BNBBERT): Trade cryptocurrencies on the German-focused exchange.

- Binance Singapore (BNBSGDUSD)

: Trade BNB and other cryptocurrencies against SGD.

These partnerships enable users to trade on multiple platforms, reducing trading costs and increasing market visibility. Additionally, Binance’s robust API provides developers with a seamless experience for building their own applications and services.

Futures Trading in Cryptocurrency Market

Cryptocurrency futures are a relatively new concept in the cryptocurrency space. Futures contracts allow traders to hedge against potential price movements or speculate on future market trends. In recent years, crypto futures have gained significant attention, with several exchanges launching their own platforms.

BNB’s role in the crypto futures market is multifaceted:

- Funding Liquidity

: As a widely traded token, BNB serves as a liquidity provider for various cryptocurrency futures contracts.

- Tokenized Exchanges: Binance has launched its own futures platform on the Binance Chain, allowing users to trade on their own terms.

The integration of cross-platform trading and BNB in the crypto market is expected to drive innovation and growth in the following ways:

- Increased Accessibility: Users will be able to access a broader range of exchanges, reducing transaction costs and increasing market visibility.

- Diversification Opportunities: With BNB’s inclusion in various cryptocurrency futures contracts, users can diversify their portfolios across different asset classes.

- Improved User Experience: Seamless cross-platform trading capabilities will enhance the overall user experience, making it easier for traders to navigate complex markets.

Ethereum: Bridging On-chain Data with LLM Models: Retrieving Token Information (Solidity + GPT)

Here is an article on Ethereum connecting on-chain data to LLM models:

Connecting On-Chain Data to LLM Models: Retrieving Token Information in Solidity

As a developer creating a token, you are constantly looking for ways to improve the user experience and streamline the functionality of your application. One innovative approach that can significantly improve the efficiency of your project is to integrate large language models (LLMs) like GPT into on-chain data retrieval. In this article, we will learn how to connect on-chain data to LLM models in Solidity.

What are LLMs?

Large language models, such as Google’s Transformer-based models, have revolutionized natural language processing and have shown great potential in various applications. They consist of a massive set of textual data, which they can learn to process and generate human-like responses. These models have many advantages over traditional data mining methods:

- Speed

: LLMs can analyze large amounts of data in a fraction of the time it would take traditional methods.

- Accuracy: By leveraging large datasets, LLMs can provide highly accurate answers to complex queries.

- Scalability: With a massive training dataset, LLMs can handle high volumes of user queries.

Challenges and Limitations

While LLMs are an excellent solution for on-chain data mining, there are several challenges and limitations that need to be considered:

- Data Requirements: Creating and maintaining large datasets for LLMs is time-consuming and costly.

- Data Quality: Ensuring the accuracy and relevance of the generated answers requires high-quality training data.

- Token-specific data: Retrieving token information such as balance, owner addresses, or created tokens may require custom models tailored to your specific token.

Bridging on-chain data with LLM models

To address these challenges, we will focus on building a bridge between on-chain data and LLM models. This will allow users to query your token data directly in the application using natural language queries.

Here is an example of how you can implement this in Solidity:

pragma solidity ^0.8.0;

contract TokenInfo {

mapping(address => uint256) public balances;

function getBalance(useraddress) internal view returns (uint256) {

return balances[user];

}

function getTokenMinted(uint256 _mintedToken) inner view return (bool) {

// This is a placeholder for your custom logic

// You can implement this logic based on your token requirements

boolean minted = true;

return minted;

}

}

pragma solidity ^0.8.0;

contract Bridge {

public tokenAddress address; // The address of the token you want to query

structure TokenData {

uint256 balance;

uint256 token minted;

}

function getBalance(userAddress) inner view return (uint256) {

return bridges[tokenAddress][user].balance;

}

function getTokenMinted(uint256 _mintedToken) internal view return (bool) {

return bridges[tokenAddress][_mintedToken].minted;

}

}

BridgeManager contract {

Bridge[] public bridges; // Store bridge mappings

constructor() {

bridges.push(Bridge(0x...)); // Replace with your token address

}

function getBalance(userAddress, uint256 _token) internal view return (uint256) {

TokenData data = bridges[user][_token];

return data.balance;

}

function getTokenMinted(uint256 _token, uint256 _mintedToken) internal view return (bool) {

TokenData data = bridges[_token][_mintedToken];

return data.minted;

}

}

In this example, we created a “Bridge” contract that acts as a bridge between the on-chain data and the LLM models.

- Speed