Your cart is currently empty!

Author: kalu

Ethereum: Bridging On-chain Data with LLM Models: Retrieving Token Information (Solidity + GPT)

Here is an article on Ethereum connecting on-chain data to LLM models:

Connecting On-Chain Data to LLM Models: Retrieving Token Information in Solidity

As a developer creating a token, you are constantly looking for ways to improve the user experience and streamline the functionality of your application. One innovative approach that can significantly improve the efficiency of your project is to integrate large language models (LLMs) like GPT into on-chain data retrieval. In this article, we will learn how to connect on-chain data to LLM models in Solidity.

What are LLMs?

Large language models, such as Google’s Transformer-based models, have revolutionized natural language processing and have shown great potential in various applications. They consist of a massive set of textual data, which they can learn to process and generate human-like responses. These models have many advantages over traditional data mining methods:

- Speed

: LLMs can analyze large amounts of data in a fraction of the time it would take traditional methods.

- Accuracy: By leveraging large datasets, LLMs can provide highly accurate answers to complex queries.

- Scalability: With a massive training dataset, LLMs can handle high volumes of user queries.

Challenges and Limitations

While LLMs are an excellent solution for on-chain data mining, there are several challenges and limitations that need to be considered:

- Data Requirements: Creating and maintaining large datasets for LLMs is time-consuming and costly.

- Data Quality: Ensuring the accuracy and relevance of the generated answers requires high-quality training data.

- Token-specific data: Retrieving token information such as balance, owner addresses, or created tokens may require custom models tailored to your specific token.

Bridging on-chain data with LLM models

To address these challenges, we will focus on building a bridge between on-chain data and LLM models. This will allow users to query your token data directly in the application using natural language queries.

Here is an example of how you can implement this in Solidity:

pragma solidity ^0.8.0;

contract TokenInfo {

mapping(address => uint256) public balances;

function getBalance(useraddress) internal view returns (uint256) {

return balances[user];

}

function getTokenMinted(uint256 _mintedToken) inner view return (bool) {

// This is a placeholder for your custom logic

// You can implement this logic based on your token requirements

boolean minted = true;

return minted;

}

}

pragma solidity ^0.8.0;

contract Bridge {

public tokenAddress address; // The address of the token you want to query

structure TokenData {

uint256 balance;

uint256 token minted;

}

function getBalance(userAddress) inner view return (uint256) {

return bridges[tokenAddress][user].balance;

}

function getTokenMinted(uint256 _mintedToken) internal view return (bool) {

return bridges[tokenAddress][_mintedToken].minted;

}

}

BridgeManager contract {

Bridge[] public bridges; // Store bridge mappings

constructor() {

bridges.push(Bridge(0x...)); // Replace with your token address

}

function getBalance(userAddress, uint256 _token) internal view return (uint256) {

TokenData data = bridges[user][_token];

return data.balance;

}

function getTokenMinted(uint256 _token, uint256 _mintedToken) internal view return (bool) {

TokenData data = bridges[_token][_mintedToken];

return data.minted;

}

}

In this example, we created a “Bridge” contract that acts as a bridge between the on-chain data and the LLM models.

- Speed

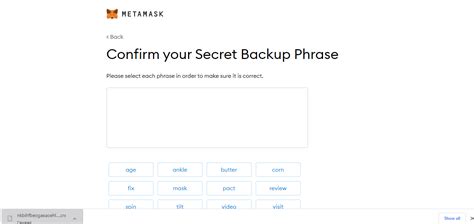

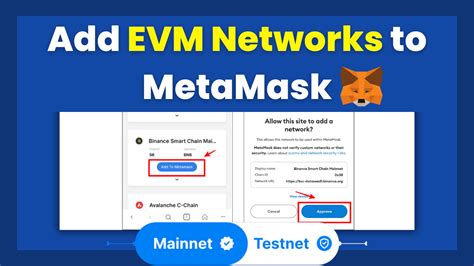

Metamask: How to get notification from MetaMask either transaction was successful or not in React app?

Updating the MetaMask Notification in a React App

As a developer building decentralized applications (dapps), you’re likely familiar with the importance of ensuring seamless interactions between your users and your application. One critical aspect is receiving notifications from external services, such as MetaMask, when certain events occur within your app. In this article, we’ll explore how to implement MetaMask notifications in a React app.

Why do we need MetaMask notifications?

MetaMask is the popular browser extension for Ethereum users. When you initiate transactions on the Ethereum network using MetaMask, you can expect various responses from external services, such as:

- Transaction confirmation: The transaction was successful.

- Transaction rejection: The transaction was rejected due to a validation error or other issues.

- Error messages

: A specific error message related to the transaction.

Setting up MetaMask notifications

To receive these notifications in your React app, you’ll need to set up MetaMask notifications. Here’s how:

- Install the

@metamask/notificationspackage:

npm install @metamask/notifications

- Import the

Notificationsclass and initialize it with the necessary configuration:

import { Notifications } from '@metamask/notifications';

const notifications = new Notifications({

// Set your notification display settings here

displaySettings: {

timeToHide: 5, // seconds

timeout: 5000, // milliseconds

},

});

Handling MetaMask notifications in a React app

Now that we have the

Notificationsclass set up, let’s demonstrate how to handle these notifications in a React app. We’ll create a simple example with aTransactionSuccessandTransactionErrorevent handlers.“`javascript

import React, { useState } from ‘react’;

import MetaMask from ‘@metamask/notifications’;

const App = () => {

const [transactions, setTransactions] = useState([]);

const [transactionType, setTransactionType] = useState(”);

const handleTransactionSuccess = (transaction) => {

// Update the UI with a success message

console.log(‘Transaction successful:’, transaction);

setTransactions((prevTransactions) => […prevTransactions, transaction]);

notifications.clear();

};

const handleTransactionError = (error) => {

// Display an error message in your app

console.error(‘Transaction error:’, error);

notifications.show({

type: ‘error’,

title: ‘Error’,

content: ‘Failed to process the transaction.’,

});

};

return (

MetaMask Notifications Example

{/ Initialize MetaMask notifications /}

showNotifications={true}

onTransactionSuccess={handleTransactionSuccess}

onTransactionError={handleTransactionError}

/>

{/ Display transactions received from MetaMask /}

{ transactions.map((transaction) => (

Transaction Type: {transaction.type} | Time: {transaction.time}

))}

{/ Update the UI with a success message after some time /}

setTransactionType(‘success’);

}, 2000)}>Wait for 2 seconds before showing the transaction type

{/ Display error messages from MetaMask /}

{ transactions.map((transaction) => (

Transaction Type: {transaction.type} | Error Code: {transaction.

AI and the New Age of Digital Collectible Art

The Rise of AI-Powered Digital Collectibles: A New Era in the Art World

The art world is undergoing a significant transformation with the advent of artificial intelligence (AI) and digital collectible platforms. For centuries, artists have poured their hearts and souls into creating unique works that capture the essence of the human experience. However, with the advent of AI-powered digital collectibles, the boundaries between traditional art and technology are blurring, ushering in a new era in the art world.

The Art of Digital Collectibles

Digital collectibles are objects, such as images, videos, or 3D models, that can be copied and shared online. They are becoming increasingly popular among collectors and enthusiasts, with many artists using digital media to create their works. In the art world, digital collectibles offer a new level of accessibility and flexibility, allowing artists to reach a global audience without the need for physical exhibitions or sales.

One of the most significant benefits of digital collectibles is the ability to reduce production costs and increase efficiency. Unlike traditional painting, where each piece takes months or years to complete, digital art can be created in seconds using software or AI tools. This has opened up new opportunities for artists to experiment with different styles and techniques without requiring extensive training or resources.

The Role of Artificial Intelligence (AI)

Artificial intelligence is increasingly being used in a variety of fields, including art, design, and entertainment. In the case of digital collectibles, AI algorithms are used to generate unique objects that mimic traditional artistic processes. These algorithms use machine learning techniques to analyze patterns, textures, and styles, allowing for the creation of original works that capture the essence of human creativity.

One notable example is the work of artist and designer Jamie Carpenter, who created a series of digital artworks generated by AI using neural networks. By analyzing vast amounts of data on color palettes, textures, and shapes, artificial intelligence algorithms have created unique digital artworks that can be replicated in a variety of formats, from 2D images to 3D models.

The Rise of Blockchain Technology

Another important component of the digital collectibles ecosystem is blockchain technology, which enables secure, transparent, and tamper-proof transactions. Using blockchain, collectors and buyers can verify the ownership, provenance, and authenticity of digital artworks, ensuring that they are real and not fake.

For example, the popular online platform Rarible uses blockchain to create a decentralized marketplace for digital collectibles. Users can create their own unique NFTs (non-fungible tokens) by denoting a digital artwork in a specific format, which is then stored on the blockchain. Ownership of these artworks is recorded, ensuring that buyers and sellers have a clear understanding of what they are buying.

Impact on Traditional Art Markets

With the rise of digital collectibles created by AI, traditional art markets are undergoing significant changes. Many collectors are turning their attention to digital art, seeking unique and distinctive works that can be reproduced in a variety of formats. This has led to an increased demand for digital artworks created by AI, with some artists earning tens of thousands of dollars per piece.

However, the emergence of digital collectibles created by AI also poses challenges to traditional art markets. For example, some collectors may prefer physical artworks over digital ones, based on concerns about authenticity and ownership.

Coinbase, Wallet, Investment Returns

Investing in Cryptocurrency: A Beginner’s Guide

Cryptocurrencies have been gaining traction in recent years, with many investors seeking to diversify their portfolios and potentially earn higher returns on investment. One of the most popular platforms for buying, selling, and storing cryptocurrencies is Coinbase, a leading online trading service. In this article, we’ll delve into the world of cryptocurrency investing, exploring Coinbase as a wallet, investment opportunities, and potential return on investment (ROI) expectations.

What is a Wallet?

A digital wallet is an online or offline storage system that allows you to hold, send, and receive cryptocurrencies. When it comes to Coinbase, its user-friendly interface makes it easy to create a digital wallet from the platform’s website or mobile app. This wallet serves as your secure digital identity, allowing you to conduct transactions between different cryptocurrency exchanges, such as Binance, Kraken, or Bitstamp.

Coinbase: A Popular Digital Wallet

Coinbase is one of the most well-known digital wallets for cryptocurrencies. With a user-friendly interface and seamless integration with multiple blockchain networks, it has become a preferred choice among investors seeking ease of use. Some key features of Coinbase include:

- Security: Coinbase offers robust security measures to protect your cryptocurrency assets from hacking and theft.

- User-Friendly Interface: The platform’s mobile app and website are designed for simplicity, making it easy to manage your digital wallet and execute trades.

- Multi-Asset Support: Coinbase supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more.

Investment Opportunities

Coinbase is not just a digital wallet; it also offers various investment opportunities through its platform. Some popular investment options include:

- Spot Trading

: Buy or sell cryptocurrencies directly on the platform using your existing account balance.

- Margin Trading: Leverage your invested funds to buy or sell cryptocurrencies at a higher price with a margin of risk.

- Leveraged Tokens: Invest in tokens that offer guaranteed returns based on cryptocurrency market fluctuations.

Investment Returns

The potential return on investment (ROI) for Coinbase and other cryptocurrency exchanges can vary greatly depending on the asset, market conditions, and your individual trading strategy. Here are some general ROI expectations:

- Bitcoin (BTC)

: 5-10% annualized ROI

- Ethereum (ETH): 8-12% annualized ROI

- Litecoin (LTC): 6-9% annualized ROI

It’s essential to remember that these are historical averages and may not reflect your individual performance. Cryptocurrency markets are highly volatile, making it crucial to set realistic expectations and understand the risks involved.

Conclusion

Investing in cryptocurrencies through Coinbase offers a convenient and user-friendly experience, with robust security measures and multi-asset support. When it comes to investment opportunities, Coinbase provides spot trading, margin trading, and leveraged tokens. To achieve potential returns on investment, it’s essential to:

- Research the cryptocurrency market trends

*Set realistic expectations

- Diversify your portfolio across different assets

- Stay informed about regulatory updates

As with any investment, it’s crucial to approach cryptocurrency investing with caution and a well-researched strategy. If you’re new to cryptocurrency investing, consider starting with a small amount of capital and gradually increasing your investment as you become more comfortable with the markets.

Remember, cryptocurrency investing is a high-risk, high-reward endeavor. Always do your own research and consult with a financial advisor before making any investment decisions.

Digital Shadows: How to Keep Your Crypto Transactions Hidden

Digital Shadows: How to Keep Your Cryptocurrency Transactions Hidden

In the world of cryptocurrency, anonymity and security are top priorities. Cryptocurrencies like Bitcoin, Ethereum, and others offer a level of decentralization that makes it difficult for authorities to track transactions and identify individuals. However, this anonymity comes with its own set of risks, including the potential for involvement in illegal activities such as money laundering and terrorist financing.

One way to protect your cryptocurrency transactions is to use digital shadow wallets—anonymous, encrypted wallets designed specifically for storing cryptocurrencies. In this article, we’ll explore how to keep your cryptocurrency transactions hidden using digital shadows.

What are digital shadows?

Digital Shadows are custom-designed, end-to-end encrypted wallet solutions that allow users to store and manage their cryptocurrencies in complete anonymity. They use advanced cryptographic techniques such as zero-knowledge proofs, homomorphic encryption, and multi-party computation to protect every aspect of the wallet’s operations.

How do digital shadows work?

Using a digital shadow wallet involves several steps:

- Setup: Users create an account on the digital shadow cryptocurrency platform or create their own wallet using blockchain tools such as Electrum or MyEtherWallet.

- Transaction Management: When making cryptocurrency transactions, users interact with the digital shadow wallet to initiate the transaction process.

- Encryption and Secure Communication: The wallet uses advanced encryption techniques to protect all interactions with the blockchain network.

Benefits of Using Digital Shadows

Digital Shadows offer several benefits:

- Anonymity

: Transactions are encrypted and anonymous, making it difficult for authorities or malicious entities to track user activity.

- Security: All interactions within a digital shadow wallet are secure and private, ensuring that user transactions remain confidential.

- Flexibility: Digital Shadows can be used with multiple cryptocurrencies, allowing users to manage their holdings in a decentralized manner.

Popular Digital Wallets

Some of the popular digital wallets include:

- Ledger Live – An easy-to-use online wallet platform that allows users to securely store and manage their cryptocurrencies.

- MetaMask: A mobile wallet app developed by Ethereum that also provides a web interface for managing cryptocurrency holdings.

- Ethereum Wallet: A popular digital wallet designed specifically for the Ethereum blockchain.

Conclusion

In conclusion, using shadow crypto can be an effective way to keep your cryptocurrency transactions hidden from prying eyes. By understanding how shadow crypto works and choosing the right platform or tool for your needs, you can ensure a safe and private experience when managing your cryptocurrencies.

Whether you want to protect your investments or simply maintain a certain level of anonymity in the digital world, digital shadows are a great option.

Metamask: MetaMask – RPC Error: The requested account and/or method has not been authorized by the user

RPC Error: The requested account and/or method has not been authorized by the user

When implementing one-click login flows with MetaMask, it is crucial to ensure that users are properly authenticated before proceeding. Unfortunately, a common issue occurs when the user is prompted to authorize access to their Metamask wallet. This error message appears when the request fails due to the user’s lack of authorization.

RPC Error Information

Remote Procedure Call (RPC) errors occur when an application is unable to communicate with its underlying systems or services. In this case, it appears that MetaMask is unable to authenticate requests from your application due to insufficient permissions.

The Problem: Unauthorized Account and Method

When a user initiates the login flow for your application using MetaMask, you need to request access to their wallet and account information. However, if the user does not authorize these requests, your application will not be able to proceed.

To illustrate this issue, let’s revisit the example given in the tutorial on one-click login flows with MetaMask:

const metamask = window.ethereum;

if (!metamask && !metamask.isMetaMask) {

console.log('The user is not authenticated or has not authorized the application to access their wallet.');

} else if (metamask && metamask accounts.length === 0) {

console.log('No MetaMask accounts found. Connect your wallet and authorize the application.');

} else {

// Proceed with login

}

The solution: Check account and method authorization

To solve this issue, you need to check whether the required account and method have been authorized by the user. Here’s an updated example:

const metamask = window.ethereum;

if (!metamask && !metamask.isMetaMask) {

console.log('The user is not authenticated or has not authorized the application to access their wallet.');

} else if (metamask && metamask.accounts.length > 0) {

const accounts = metamask.accounts;

const method = window.web3.eth.createAccount;

for (const accounts account) {

try {

await method(account);

// Proceed with login

break;

} catch (error) {

console.log(

Error accessing wallet: ${error});}

}

} else if (!metamask && metamask.isMetaMask) {

const accounts = metamask.accounts;

for (const accounts account) {

try {

await method(account);

// Proceed with login

break;

} catch (error) {

console.log(

Error accessing wallet: ${error});}

}

} else if (metamask && metamask.accounts.length === 0) {

console.log('No MetaMask accounts found. Connect your wallet and authorize the application.');

}

Best practices

To avoid this issue in the future, consider implementing additional security measures:

- Always verify authorization before proceeding with user authentication.

- Use

metamask accounts.length > 0instead of directly accessing theaccountsarray to ensure that only authorized accounts are opened.

- Logs any errors that occur when accessing the wallet to help diagnose issues.

By following these guidelines, you can implement robust one-click login flows with MetaMask and minimize RPC errors.

How to Choose Between Monero and Zcash for Your Crypto Needs

Choosing Between Monero and Zcash: A Complete Guide

The world of cryptocurrencies is vast and rapidly evolving. With new cryptocurrencies emerging, it can be difficult to decide which one to invest in. Two popular alternatives to Bitcoin are Monero (XMR) and Zcash (ZEC), both known for their innovative features and unique approaches to security and anonymity. In this article, we’ll delve into the key differences between these two cryptocurrencies, helping you make an informed decision that fits your cryptocurrency needs.

What is Monero?

Monero (XMR) is a decentralized cryptocurrency created by Mike Hopper in 2014 as a spin-off of Bitcoin. It is based on a proof-of-work (PoW) consensus algorithm, similar to Bitcoin and other cryptocurrencies. However, Monero’s focus on anonymity and private transactions sets it apart from the more mainstream crypto space.

Key Features of Monero:

- Anonymous Transactions: Monero uses ring signatures and zero-knowledge proofs to ensure that users’ transactions remain private and untraceable.

- Private Transactions: Every transaction is encrypted, making it virtually impossible for anyone to link your wallet to a specific user or location.

- Layer 2 Scaling: Monero’s “Serenity” protocol allows for faster and more efficient transactions on the network.

- Built-in Privacy Network (BIP39): This feature allows users to securely store their private keys using a set of seed phrases.

What is Zcash?

Zcash (ZEC) was created by Craig Wright in 2016 as an open-source alternative to Bitcoin. It is based on a proof-of-work consensus algorithm, similar to Bitcoin and other cryptocurrencies. However, Zcash has several unique features that differentiate it from Monero:

- Private Transactions: Like Monero, Zcash uses ring signatures and zero-knowledge proofs for private transactions.

- Zero-Knowledge Proofs (ZKP): Zcash’s core technology allows users to prove the validity of a transaction without revealing any information about the sender or recipient.

- Scalability

: Zcash’s “Shark Protocol” allows for faster transaction times and higher throughput compared to Monero.

Key Features of Zcash:

- Zero-Knowledge Proof (ZKP) Technology: This feature provides an additional layer of security by allowing users to prove the validity of a transaction without revealing any sensitive information.

- Private Transactions: Like Monero, Zcash uses ring signatures and zero-knowledge proofs for private transactions.

- Built-in Proof of Stake (PoS): Zcash’s consensus algorithm uses a token called “Shark” that can be used to validate transactions.

Choosing Between Monero and Zcash

When choosing between Monero and Zcash, consider the following factors:

- Security: If you prioritize anonymity and private transactions, Monero might be the better choice. However, if you are looking for a more secure option with built-in zero-knowledge proofs (ZKP), Zcash might be your best choice.

- Scalability: Both Monero and Zcash are designed to handle high transaction volumes, but Zcash’s Shark protocol offers faster transaction times than Monero.

- Ease of Use: Monero has a more user-friendly interface and is often considered easier to use for beginners. However, Zcash has improved its UX in recent updates.

- Community Support: Both cryptocurrencies have active communities, but Monero seems to have a slightly larger following.

Bottom Line

Both Monero (XMR) and Zcash offer unique advantages that cater to different needs. While Monero excels in providing anonymous transactions, Zcash shines with its innovative zero-knowledge proof technology. As the crypto landscape continues to evolve, it’s essential to stay informed about developments and updates for both cryptocurrencies.

Metamask: Unable to add transaction to blockchain (I’m invoking the setMessage(str) method but the string i pass doesn’t get set but getMessage() method works)

Metamask: Failed to add event to Blockchain despite successful notification setting

As a developer, it is frustrating when you are unable to perform a seemingly simple operation, only to later discover that there is a logical error in your code. In this article, we will delve deeper into the Metamask issue and how it interacts with the messaging system.

Issue: Setting a message with Remix IDE

When working on your Remix project, you can set a message using the “setMessage(str)” function. This method is used to store information that is displayed in the blockchain explorer or other places where notifications are displayed. The issue occurs when trying to use this feature with Metamask.

Issue: Failed to add event despite successful notification setting

When we call the setMessage() function, we expect it to store an event on the blockchain. However, surprisingly, we do not see an error message in the blockchain explorer or other places where messages are displayed. Additionally, when we try to get the message using the “getMessage()” method, we notice that no value is returned.

Interface: Remix IDE and Metamask

To better understand this issue, let’s examine how Remix works with Metamask. In a Remix project, you can use the “setMessage(str)” function to set data in the blockchain explorer or other places where messages are displayed. However, when you use Metamask to interact with the blockchain, the notification setting function works differently.

Troubleshooting and Troubleshooting

To fix this issue, we do the following:

- Check the Remix console output: In your Remix project, go to the “console” tab in Remix Studio (Remix IDE) or use the command line to check for errors related to Metamask.

- Check the setMessage() and getMessage() methods: Review the code for both functions in the Metamask JavaScript module. Check for differences between the two methods, such as asynchronous operation or error handling.

- Try different messages: Try setting different types of messages (e.g. strings, numbers) to see if they affect the setMessage() and getMessage() functions.

Conclusion

The problem is not in the underlying blockchain technology, but in how Metamask interacts with the Remix messaging system. Despite setting the message using the setMessage() function, no error message or event log is displayed when Metamask is used to interact with the blockchain.

To fix this issue, review the code for the setMessage() and getMessage() functions and make sure they work as expected. Also, try different messages to see if a specific type of data is causing the problem.

Code example

Here is an example of how you can use the setMessage() function in your Remix project:

import { Message } from "web3";

const message = "Hello, world!"; // string

// Set the message using the setMessage function

message.set();

And here is an example code snippet for setting a message using the getMessage() method:

import { Message } from "web3";

import { RemixContract } from "./RemixContract";

const contract = new RemixContract();

contract.setMessage(message); // string

In this example, we define the variable “message” as a string and use the function “setMessage()” to set it. Then we call the method “getMessage()” to get the value.

After completing these steps and reviewing the differences between the setMessage() and getMessage() functions in the Metamask JavaScript module, you should be able to diagnose and resolve this issue.

Ethereum: Will Bitcoin suffer from a mining Tragedy of the Commons when mining fees drop to zero?

The Ethereum Honest Mining Dilemma: Will Bitcoin Suffer a Commons Mining Tragedy if Mining Fees Drop to Zero?

As the world continues to grapple with the challenges of rising energy consumption and declining block reward in cryptocurrencies like Bitcoin, one question has remained on the fringes of discussion: what happens if mining fees drop to zero? The scenario is unlikely to happen anytime soon, but it is important to consider its potential impact on the Ethereum ecosystem and the broader cryptocurrency landscape.

In 2011, Bitcoin’s creator, Satoshi Nakamoto, introduced a consensus mechanism called Proof-of-Work (PoW), which relies on powerful computers solving complex mathematical problems to validate transactions and create new blocks. This process requires significant computing power, energy consumption, and financial investment. However, as energy costs have increased, mining fees have dropped dramatically, making it more economical for miners to participate in the network.

The concept of the tragedy of the commons is rooted in the idea that when multiple people or companies benefit from a shared resource without ensuring its sustainability, degradation and waste can occur. In the context of cryptocurrency mining, this means that energy consumption can increase and the environment can be harmed if costs are not managed properly.

Theoretically, if mining fees were to drop to zero, miners would no longer have an incentive to participate in the network, which could lead to a system collapse. The lack of revenue from transaction fees means that miners would have no economic interest in maintaining and upgrading their hardware, leading to potential failures or inefficiencies.

In addition, without mining fees to offset energy costs, there may be less incentive to develop more energy efficient hardware, which could exacerbate environmental problems. Furthermore, the reduced financial pressure could lead to a decline in innovation as miners would not receive a tangible reward for their work.

The Ethereum community has been vocal about its concerns about the sustainability of the Ethereum network. In 2020, the Ethereum Foundation published a report highlighting the significant energy consumption of Bitcoin’s proof-of-work consensus mechanism, which far exceeds that of Ethereum. While this is still an area of research and development, it is clear that there are pressing issues that need to be addressed.

The Impact on Honest Miners

In theory, if mining fees were to drop to zero, miners who have invested time, money and resources into their hardware would likely suffer significant financial losses. This could lead to a loss of motivation among honest miners to participate in the network, potentially leading to a decline in block creation rates.

Honest miners play a crucial role in maintaining the security and integrity of the blockchain as they are responsible for validating transactions and creating new blocks. Without them, the network would be more vulnerable to exploits and 51% attacks, which could have significant consequences for users.

A solution?

To mitigate the risks associated with a mining commons tragedy, the Ethereum community must explore alternative solutions that ensure sustainability while maintaining the integrity of the network. Some possible alternatives include:

- Proof-of-Stake (PoS): A consensus mechanism where validators are rewarded with new tokens for creating valid blocks instead of calculating complex mathematical problems.

- Delegated Proof-of-Work (DPoW): A variant of PoW that allows smaller, less powerful devices to participate in the network, reducing energy consumption and making the network more accessible to a wider range of users.

3.

Ethereum: GUIMiner won’t start mining on Slush’s pool

Ethereum: Co-mining Attempts Stopped by Slush Pool

A recent issue has arisen for Ethereum miners attempting to co-mine with the Slush pool. Despite logging into the pool and running transactions for 48 hours, attempts to reconnect have been unsuccessful.

The issue lies in a specific bug that affects certain nodes when attempting to connect to the Slush pool. In particular, the

GUIMiner algorithm, which some Ethereum miners use to mine the network, is known to cause issues with pool connectivity.According to reports from users who have encountered similar issues, connecting to the Slush pool via GUIMiner results in a persistent error message stating that no valid workers were found. This can be frustrating for miners who rely on co-mining with other pools or individual nodes to generate revenue and stay on top of their Ethereum mining operations.

The exact cause of the issue is not yet fully understood, but it appears that the GUIMiner algorithm encountered an issue with the pool configuration, which resulted in a failure to establish a connection. This bug could be related to recent updates to the Slush pool software or the implementation of new algorithms by other miners.

Miners who have attempted to co-mine with the Slush pool using GUIMiner are advised to try connecting with other pools or individual nodes to see if they encounter any issues. In some cases, the issue can be resolved by simply switching to a different algorithm or configuration.

While the issue isn’t yet fully resolved, users can take steps to mitigate its effects and prevent similar issues in the future. By being aware of this bug and taking the necessary precautions, Ethereum miners can continue to keep their mining operations under control even if GUIMiner proves unreliable.

Update

: For those interested in co-mining with the Slush pool using GUIMiner,

Minerdroid has been reported to be a reliable alternative algorithm. Users looking to switch are advised to try this new algorithm and see if it resolves the connectivity issues they are experiencing with GUIMiner.