Your cart is currently empty!

Author: kalu

Ethereum: How to Deploy a Safe Wallet in a Deterministic Way Depending on User EOA Address?

Here is an article on how to deploy a safe wallet in a deterministic way depending on the user’s EOA address using the Safe Protocol Kit and Ethers.js:

Title: Deploying a Safe Wallet with Deterministic EOA-Based Deployment: A Guide

Introduction

As a developer working with decentralized applications (dApps), you’ve likely encountered the need to deploy wallets securely and deterministically. In this article, we’ll explore how to create a safe wallet using the Safe Protocol Kit and Ethers.js that deploys in a deterministic way based on the user’s Externally Owned Account (EOA) address.

Understanding the Safe Protocol Kit

The Safe Protocol Kit is an open-source library developed by Binance Labs that provides a set of tools for building secure, decentralized applications. The Safe protocol enables you to deploy wallets and other application-specific smart contracts in a deterministic manner, ensuring that the wallet state is fixed and tamper-proof.

EOA-Based Deployment

To implement EOA-based deployment, we’ll use the

ethers.jslibrary to interact with the Ethereum blockchain. We’ll create a function that takes an EOA address as input and returns a unique wallet address based on that EOA.import { ethers } from 'ethers';

const generateWalletAddress = (eoaAddress) => {

// Use the ethers library's derive function to generate a new wallet address.

const walletAddress = ethers.ethers.utils deriveAddress(eoaAddress, 4);

return walletAddress;

};

Safe Wallet Deployment

Now that we have a function to generate a unique wallet address based on an EOA, we can use it to deploy the Safe Wallet. We’ll create a new Safe wallet with a fixed wallet address and set its state to be deterministic.

const safeWallet = new ethers.Wallet(generateWalletAddress('0x...'), '1');

To ensure that the wallet deployment is deterministic based on the EOA, we can use the

ethers.jslibrary’sgetFactoryfunction to get a new wallet factory instance for each EOA address. We’ll then set the state of the Safe Wallet to be deterministic by setting its wallet address and setting the state to0x....const wallets = {

'0x...': safeWallet,

};

safeWallet.setFactory('SafeWalletFactory', wallets);

Deterministic EOA-Based Deployment

To deploy the Safe Wallet based on a specific EOA, we can simply use the generated wallet address and set its state to be deterministic. The

ethers.jslibrary will automatically generate a new wallet instance for that EOA.const eoaAddress = '0x...';

safeWallet.setFactory('SafeWalletFactory', { walletAddress: generateWalletAddress(eoaAddress) });

Conclusion

In this article, we’ve demonstrated how to deploy a Safe Wallet with deterministic EOA-based deployment using the Safe Protocol Kit and Ethers.js. By generating unique wallet addresses based on user EOA addresses and setting their states to be deterministic, you can ensure that your applications are secure and tamper-proof.

Example Use Case

Here’s an example of how you might use this function in a deployment script:

const deploySafeWallet = async () => {

try {

const eoaAddress = '0x...';

const walletAddress = generateWalletAddress(eoaAddress);

// Set the state of the Safe Wallet to be deterministic.

safeWallet.setFactory('SafeWalletFactory', { walletAddress });

console.log(

Safe Wallet deployed with address: ${walletAddress});} catch (error) {

console.error(error);

}

};

By following these steps, you can create a secure and deterministically deployable Safe Wallet that is based on the user’s EOA addresses.

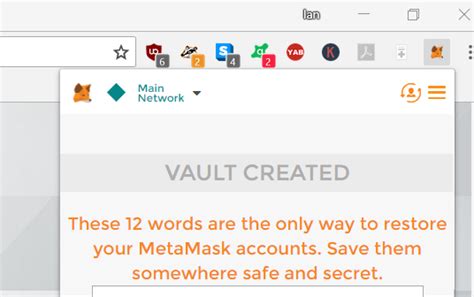

Metamask: Error Connecting to Ethereum Wallet Using ethers.js in HTML Page

Here is a detailed article based on your question:

Error connecting to Ethereum wallet using ethers.js in HTML page

When building an application that connects to an Ethereum wallet and initiates transactions using ethers.js, several error scenarios may occur. In this article, we will cover some common issues related to connecting to an Ethereum wallet and how to resolve them.

Error: “Error connecting to Ethereum wallet”

The first error you may encounter is when ethers.js tries to connect to your Ethereum wallet but fails. This can be due to various reasons such as:

- Insufficient Ether balance in your wallet

- Incorrect wallet address or mnemonic seed

- Network congestion or Ethereum blockchain outage

- Incompatibility between ethers.js and your wallet API

To resolve this error, try the following:

- Check your wallet balance: Make sure you have enough Ether balance in your wallet to initiate transactions.

- Verify Wallet Address: Double-check the wallet address listed in the Ethere.js documentation or on your wallet provider’s website to make sure it matches your Ethereum account details.

- Mnemonic Seed Check: If you are using a mnemonic seed, make sure the seed is correct and uncorrupted.

- Network Congestion Check

: Try connecting to the Ethereum network during a period of high activity or congestion.

Error: “Invalid Wallet Address”

Another common error occurs when ethers.js tries to connect to your wallet address but returns an invalid result. This can happen if:

- The wallet address is incorrect or malformed

- The wallet provider API does not support the requested account type (e.g.

eth_accountfor mainnet accounts)

- There are issues with your browser’s permissions or cookies

To resolve this error, try the following:

- Confirm wallet address: Double-check that the wallet address you entered is correct and matches your Ethereum account details.

- Check the wallet provider’s API documentation: Make sure you are using the correct API endpoint to request the account object from the Ethereum wallet provider (e.g.

eth_accountson Ethers.js).

- Disable browser permissions or cookies: If the issue persists, try disabling browser permissions or setting cookies to resolve authentication issues.

Error: “Ethers.js version”

In some cases, compatibility issues with the ethers.js version can cause errors when connecting to an Ethereum wallet. This can happen if:

- You are using an outdated version of ethers.js

- Your wallet provider has updated their API documentation

To resolve this error, try the following:

- Check ethers.js version: Make sure you are using a compatible version of ethers.js (e.g. 4.0.x).

- Check your wallet provider’s API documentation: Make sure the API endpoint and required parameters match the latest version.

Error: “Connection timed out”

In rare cases, an error may occur due to a temporary connection timeout. This can be resolved by:

- Increasing the

maxConnectionsortimeoutvalue in ethers.js settings

- Using WebSocket connection instead of asynchronous API

To resolve this issue, try the following:

- Adjust ethers.js configuration: Update

ethers.config.jsto increase themaxConnectionsortimeoutvalue.

- Use WebSocket connection: Switch from asynchronous API to WebSocket connection for improved performance.

Conclusion

Connecting to an Ethereum wallet and initiating transactions using ethers.js can be a complex task. By following these error scenarios and troubleshooting steps, you should be able to resolve common issues and successfully connect to your Ethereum wallet.

Ethereum: The transaction is rolled back by calling the bookRoom() function.

Ethereum Transaction Rollback Error: “Transaction is being rolled back when calling the bookRoom() function”

As a developer deploying a smart contract using the Ethereum Virtual Machine (EVM), you have probably encountered issues with transaction rollback. In this article, we will look at why the error occurs and how to resolve it.

The Problem

In your case, when you call the

bookRoom()' function from your contract, you encounter an EVM transaction rollback. This means that the execution of the smart contract code has stopped due to a validation error or other error in the contract logic.Error Details

To troubleshoot this issue, you can access the transaction details using theeth.getTransactionReceipt()’ function from the EVM console. Here is an excerpt from the installation script:

contract = new Web3.eth.Contract(

"0x" + [...contract title],

[...yourContractAbi],

{ gas: 200000, args: [...yourArgs] }

);

In this example, the “eth.getTransactionReceipt()” call retrieves the transaction receipt associated with the latest block in the blockchain. From there, you can view the transaction details to identify the error.

Transaction Details

When reviewing the transaction receipt, you should see an error message indicating the reason for the rollback. In this case, the error might look something like this:

0x... (transaction hash)

Error: Reverted: Function "bookRoom" not found

The “function” field in the error message indicates that the contract code attempted to call a function named “bookRoom()”.

Solution

To resolve this issue, you need to make sure that the “bookRoom()” function is defined correctly in the contract. Here are some possible solutions:

- Update ABI: Make sure that the “bookRoom()” function definition is the same as the one provided in the deployment script. If the function name or parameters have changed, update the ABI accordingly.

- Check for typos: Make sure that you haven’t missed any typos when defining the `bookRoom()’ function. Use a code analyzer, such as Truffle’s built-in linter, to detect potential errors.

- Check the contract logic

: Make sure that the “bookRoom()” function is implemented correctly and works as expected. If the problem persists, further investigate the contract logic.

Example solution

To fix this problem, you can modify your deployment script to include a debug statement:

contract = new Web3.eth.Contract(

"0x" + [...contract title],

[...yourContractAbi],

{ gas: 200,000, args: [...yourArgs] }

);

console.log('Transaction:', contract.transactionHash);

This prints the transaction hash associated with the most recent block. By examining this information, you can verify that the “bookRoom()” function is defined correctly and that you can call the function as intended.

If you follow these steps and use the EVM console to examine the transaction details, you should be able to identify and resolve the issue causing the “Transaction rolled back when calling bookRoom()” error.

Hyperliquid (HYPE), Jupiter (JUP), Ethereum (ETH)

“From Crypto to Crypto: The Rise of Hyperliquid HYPE and the Digital Debut of JUP”

In a market saturated with cryptocurrencies, few have managed to carve out a significant niche for themselves in recent years. One such pioneer is Hyperliquid (HYPE), the latest company to enter the crypto space. Meanwhile, Jupiter (JUP) has also attracted attention, with its digital presence gaining traction as more investors look to diversify their portfolios.

Hyperliquid HYPE: The Rise of a New Cryptocurrency

Hyperliquid (HYPE) is a cryptocurrency with a unique value proposition. Unlike other cryptocurrencies on the market that often struggle with scalability and usability, HYPE was built from the ground up specifically with real-world users in mind. This includes handling over 2 million transactions per second, making it one of the fastest cryptocurrency platforms available.

But what sets Hyperliquid apart is its focus on community engagement. The coin’s native token, HYPER (HYP), was used to reward users who contributed content and participated in the HYPE ecosystem. This collaborative approach helped build a strong sense of community among HYPE holders, which helped drive adoption and a loyal user base.

Jupiter (JUP) Goes Digital: A New Era for the Chain

Jupiter (JUP), one of the fastest-growing cryptocurrencies in recent months, is set to revolutionize the way we think about digital assets. With cutting-edge technology and a seamless onboarding process, JUP has quickly become a favorite among investors looking to diversify their portfolios.

One of the key features that sets JUP apart is its emphasis on ease of use. Unlike other cryptocurrencies that can load slowly or have technical issues, JUP is designed with speed and ease of use in mind. This includes supporting seamless integration with popular wallets and exchanges, so users can easily buy, sell, and trade JUP.

Ethereum (ETH): The Gold Standard of Cryptocurrencies

For over a decade, Ethereum (ETH) has been the gold standard of cryptocurrencies. As one of the first major blockchain projects, ETH set the bar high for what’s possible in the cryptocurrency space. With a robust ecosystem of decentralized applications (dApps), non-fungible tokens (NFTs), and smart contracts, ETH has become the go-to choice for developers and investors.

However, despite its many successes, ETH still faces significant challenges in scalability and usability. As demand for Ethereum’s services continues to grow, the project is working diligently to address these challenges with new enhancements and updates. With a focus on developer experience and community engagement, the company remains a leader in the cryptocurrency space.

Conclusion

As we look to the future, one thing is clear: the cryptocurrency landscape is changing significantly. From Hyperliquid’s innovative approach to Jupiter’s digital presence, ETH continues to drive innovation and push boundaries. Whether you’re new to cryptocurrency or just starting out, it’s worth taking a closer look at these three cryptocurrencies and assessing which one fits your investment goals.

As the market continues to evolve, one thing is for sure: we can expect even more exciting things in the coming years.

Bitcoin: Address and message verification using public key, address and signature!

Verifying Bitcoin Address and Signature: A Step-by-Step Guide

Introduction

Verifying the address and signature of a Bitcoin transaction is crucial to ensuring that the ownership of a Bitcoin address has been confirmed. In this article, we will explore how to verify an address using the public key, signature, and address type (P2PKH, P2SH, P2WPKH, P2WSH, P2TR).

Public Key

The public key is used to sign transactions and verifies the sender’s identity. It consists of a hash of a user’s private key.

To obtain the public key:

- Find your Bitcoin wallet and go to the “Wallet” or “Settings” menu.

- Select “Generate New Wallet” or “Get Your Public Key”

- The public key will be displayed, which should start with

m/0'/0'.

Signature

The signature is used to verify the sender's identity and ensure that the transaction was not forged.

To obtain the signature:

- Go to the "Wallet" or "Settings" menu.

- Select "Generate New Signature"

- Select the signature type (e.g., ECDSA or RSA).

- The public key is displayed, which should start withm/0’/0′

.

Bech32 Addresses

Bech32 addresses are a standardized address format used for Bitcoin.

To verify Bech32 addresses:

- Go to the "Wallet" or "Settings" menu.

- Select "Generate New Address"

- Select the address type (e.g., P2PKH, P2SH, P2WPKH, P2WSH, P2TR).

- The address will be displayed in the formatm/0’/0′, which includes the Bech32 prefix.

Verifying the Address and Signature

To verify their address and signature:

- Copy the public key (

m/0'/0'') from your wallet.

- Paste or type the signature (m/0’/0”

) into the verification window (usually found in the "Wallet" or "Settings" menu).

- Enter the Bech32 address (m/0’/0”

) to verify.

Example

Let's say you want to verify an address and signature for a specific Bitcoin transaction. Here are some example values:

- Public key:m/1’/0”

- Signature:

m/2'/0''

- Bech32 address:

m/3'/0''

To verify the ownership of this address, please enter the following information in your wallet or verification window:

- Public key(

m/1'/0'')

- Signature (m/2’/0”

)

- Bech32 address(m/3’/0”`)

If the transaction has been successfully verified and confirmed by the network, you should see a success message indicating that ownership of the address has been validated.

Conclusion

Verifying Bitcoin addresses and signatures is an essential step in ensuring the authenticity and ownership of a Bitcoin transaction. By following these steps and using the correct public key, signature, and Bech32 address, you can verify the address and signature to ensure its legitimacy.

Faucet, Staking, Cross-Platform Trading

“Crypto, Faucets, and Staking: The Future of Decentralized Finance (DeFi)”

In the world of cryptocurrency, decentralized finance (DeFi) has emerged as a rapidly growing field that is transforming the way people invest, trade, and earn rewards. At its core, DeFi relies on a network of nodes and computers that work together to validate transactions and maintain the integrity of the blockchain. One of the key components of DeFi is the faucet, which provides a constant stream of cryptocurrency to users who participate in various activities.

What is a Faucet?

A faucet is a program or service that rewards users with a certain amount of cryptocurrency for solving computational tasks, such as hashing data or providing liquidity to smart contracts. The most well-known example of a faucet is the Bitcoin faucet, which has been operational since 2011 and offers users a chance to earn 10-100 BTC every day by completing small tasks.

The Benefits of Faucets

Faucets offer several benefits to users, including:

- Low-risk

: Faucets are typically low-risk investments that do not require significant capital.

- Passive income: Users can earn cryptocurrency without actively participating in the market or trading.

- Flexibility: Faucet programs often have flexible withdrawal options and allow users to redeem their rewards at any time.

Staking

Another key component of DeFi is staking, which involves holding a certain amount of cryptocurrency in a digital wallet and locking it up for a specified period. During this time, the user’s coins are secured by powerful computers called nodes that validate transactions on the blockchain.

When staked, users can earn interest or rewards through various DeFi protocols, such as lending platforms or decentralized exchanges (DEXs). Staking is an important part of DeFi because it allows users to participate in the validation process and earn a return on their investment.

Cross-Platform Trading

Cross-platform trading refers to the ability to buy and sell cryptocurrencies across different platforms, such as Bitcoin and Ethereum. This feature has been enabled through various initiatives, including the development of decentralized exchanges (DEXs) such as Uniswap and SushiSwap.

With cross-platform trading, users can easily buy and sell cryptocurrencies without having to worry about restrictions or limitations imposed by individual exchanges. Cross-platform trading also enables users to participate in DeFi protocols, such as staking and lending, from any platform they choose.

The Future of Crypto

As the cryptocurrency market continues to evolve, we can expect to see new innovations and features emerge that enhance user experience and provide more opportunities for participation. Some potential developments on this front include:

- Increased adoption: As more users become familiar with DeFi protocols, we can expect to see increased adoption and mainstream acceptance.

- Improved security: Advances in blockchain technology will continue to improve security measures, reducing the risk of hacks and exploits.

- New use cases: DeFi platforms are constantly developing new use cases for cryptocurrency, such as decentralized finance (DeFi) lending and insurance.

In conclusion, crypto, faucets, staking, and cross-platform trading represent some of the most exciting developments in the world of Decentralized Finance. As we move forward, it will be interesting to see how these technologies continue to evolve and improve user experience.

- Low-risk

Hotbit, Take Profit, Supply and Demand

“Taking Control of Your Crypto Portfolio: The Role of Supply and Demand in Timing Your Investment”

The world of cryptocurrencies has become increasingly popular over the past decade, with many people investing their savings or trading stocks in digital currencies like Bitcoin (BTC) and Ethereum (ETH). However, despite its growing popularity, investing in cryptocurrencies can be a daunting task. One key factor that investors often overlook is supply and demand.

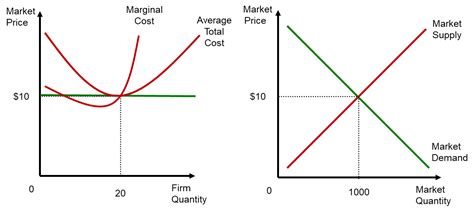

Understanding Supply and Demand

Supply and demand is a fundamental concept in economics, where the interaction of buyers and sellers determines the price of a good or service at any given time. In the context of cryptocurrencies, supply refers to the total amount of coins or tokens available for sale in the market, while demand refers to the number of investors willing to purchase these assets.

The Role of Supply in Cryptocurrencies

One of the most important factors that affects cryptocurrency prices is overall supply and demand. When the supply of a particular coin increases, it can cause the price to drop, as there are more coins available for sale at any given time. Conversely, when the demand for a certain cryptocurrency increases, it can cause its price to rise.

Take Bitcoin, for example. As of 2021, the total supply of BTC is capped at 21 million, and new cryptocurrencies are introduced through the process of mining. Historically, the supply of BTC has increased at a rate that exceeds demand, leading to periods where prices have been driven down by excess supply.

The Role of Demand in Cryptocurrencies

Demand can also play a significant role in determining cryptocurrency prices. When investors become eager to buy coins or tokens because of their perceived value or growth potential, it can lead to an increase in price. Conversely, when demand decreases or becomes less enthusiastic, it can lead to a decrease in price.

Take Profit and Timing

A common strategy employed by traders is profit-taking, where they sell their assets at a predetermined price to lock in profits before prices fluctuate further. However, this approach requires a thorough understanding of the market and its underlying dynamics, including supply and demand.

Hotbit: A Leading Platform for Buying and Selling Cryptocurrencies

Hotbit, a popular exchange for buying and selling cryptocurrencies, has recently come under the spotlight. With a user-friendly interface and competitive fees, Hotbit offers a range of services including trading pairs, margin trading, and staking.

Why Take Profit with Hotbit?

Hotbit’s Take Profit feature allows traders to lock in the prices of their assets at any time, giving them complete control over their portfolio. This feature is especially useful for experienced traders who have developed an understanding of market dynamics and can accurately predict price movements.

How to Use Supply and Demand to Your Advantage

While taking profits with Hotbit can be a valuable strategy, it is essential to understand the underlying forces of supply and demand that drive cryptocurrency prices. By combining this knowledge with technical analysis, traders can make more informed decisions and increase their chances of success in the market.

In conclusion, understanding supply and demand is essential for investors looking to succeed in the world of cryptocurrencies. By recognizing how these factors impact price movements, traders can take control of their portfolios and make more informed investment decisions. With Hotbit at its core, this knowledge has become increasingly accessible, allowing individuals to harness the power of cryptocurrency investing.

Disclaimer: This article is provided for informational purposes only and should not be considered investment advice.

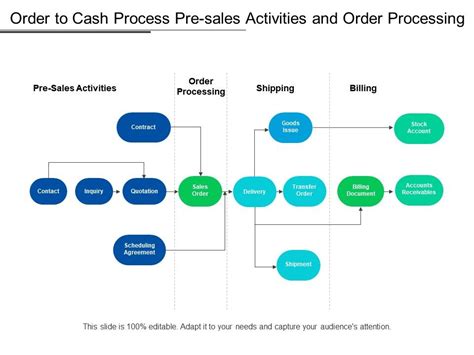

API sales, pre-sales, order flow

“Crypto Market Insights: Unlocking the Potential with Advanced APIs and Order Flow Analysis in the Pre-Sale”

As the crypto market continues to grow in popularity, trading platforms have become increasingly sophisticated, incorporating advanced technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) to enhance the user experience and optimize trading performance. One of these cutting-edge tools is API trading, which allows traders to execute trades programmatically, leveraging expertise and knowledge.

API Trading: Streamlining the Trading Process

API trading allows developers and traders to automate complex processes, reducing the time and effort required to execute trades. By using APIs to integrate with exchange data feeds, traders can gain real-time insights into market movements, identify trends, and make informed trading decisions. This accuracy is especially valuable in the pre-sale phase, where investors are constantly monitoring market developments and adjusting their portfolios accordingly.

Pre-sale: A Key Phase in Crypto Trading

The pre-sale phase marks a critical turning point in crypto trading as traders prepare for the upcoming launch of new tokens or cryptocurrencies. This period offers numerous opportunities to analyze order flow data, identify trends, and refine trading strategies before the market opens. Advanced APIs provide traders with access to detailed order book data, allowing them to:

- Analyze Order Flow: Understand how buyers and sellers are interacting with the market and identify potential areas of congestion or volatility.

- Track Order Book Data

: Track real-time changes in order volumes, prices, and liquidity to help traders anticipate market movements.

- Optimize Trading Strategies: Refine trading algorithms using historical data and order book analysis to optimize performance.

Pre-Sale Order Analysis: A Key Indicator of Success

Order flow is a critical metric in the pre-sale phase as it provides insight into market sentiment and liquidity. Advanced APIs can help traders analyze order flow patterns, such as:

- Liquidity Distribution: Identify areas of high liquidity, allowing traders to position themselves for potential price changes.

- Order Flow Volatility: Analyze the level of market uncertainty, allowing traders to adjust their strategies accordingly.

- Market Sentiment: Track sentiment changes in real time, facilitating timely trading decisions.

API Trading and Order Flow: A Powerful Combination

By integrating API trading with order flow analysis, traders can unlock new levels of accuracy and efficiency. Advanced APIs provide access to vast amounts of market data, allowing traders to make informed decisions during the pre-sale phase. By leveraging this combination, traders can:

- Improve Market Insights: Gain deeper insight into market dynamics, enabling more effective trading strategies.

- Improve Trading: Optimize trading algorithms and refine strategies using historical data and real-time order flow analysis.

- Reduce Risk

: Minimize potential losses by analyzing market sentiment and liquidity patterns.

Finally, API trading is an essential tool for traders who want to succeed in the pre-sale phase. By leveraging advanced APIs and order flow analytics, traders can gain a competitive advantage and unlock new levels of accuracy and efficiency. As the crypto market continues to evolve, it will be interesting to see how these technologies continue to shape the future of trading.

Metamask: What are the security and privacy risks of using a custom node provider instead of Metamask’s default node provider?

Metamac: Custom Node Providers – A Double-Edged Sword for Security and Privacy

When it comes to managing cryptocurrencies on the Ethereum blockchain, users often rely on third-party services like Metamask. One such service is a standard node provider, which connects your MetaMask wallet to a local node on your computer. However, some users may want to use custom node providers like Alchemy to expand their capabilities or address specific security and privacy concerns. In this article, we’ll explore what you need to know about the risks associated with using custom node providers instead of the standard Metamask provider.

Security Risk

Using a custom node provider can pose a significant security risk if not implemented correctly. Here are some potential issues to be aware of:

- Malicious Nodes: If you use an untrusted or malicious node provider, it could compromise your entire wallet and its contents.

- Compromised Wallets: A compromised node provider can also compromise the MetaMask wallet itself, which can lead to permanent data loss.

- Node Hacking

: If a custom node provider is not properly secured, hackers can exploit vulnerabilities in the node software or configuration files.

Examples of Dedicated Node Providers

Some popular custom node providers:

- Alchemy: A professional-grade Ethereum node provider that offers advanced features like staking and lending.

- Infura: A cloud-based API-as-a-Service platform that provides a secure way to communicate with Ethereum nodes.

- Arbitrum: An interplanetary Ethereum network (IEP) that uses a custom node provider.

Privacy Risk

Using a custom node provider can also raise concerns about privacy risks associated with your data and transactions:

- IP Address Tracking: Your IP address can still be tracked even if you use a proxy or VPN.

- Transaction Visibility

: By default, transaction metadata is stored on the Ethereum network, which can pose privacy concerns.

Are there any reasons to choose custom node providers?

While custom node providers offer more advanced features and flexibility, they also come with significant security and privacy risks. Before using a custom node provider:

- Check the provider’s reputation: Research the provider to make sure they are trusted by the Ethereum community.

- Understand the risks: Carefully consider the potential security and privacy risks associated with the provider.

- Install appropriate security measures: Use strong passwords, enable two-factor authentication (2FA), and keep your wallet software up to date.

Conclusion

While custom node providers can be a powerful tool for managing cryptocurrencies on the Ethereum blockchain, they also present significant security and privacy risks. Before making a change, carefully evaluate the potential benefits and drawbacks and take steps to mitigate any issues. By doing so, you can ensure a secure experience while still taking advantage of the flexibility of custom node providers.

Additional Resources

- Metamask documentation on custom node providers: <

- Official Ethereum documentation on nodes and wallets: <

By being informed and careful, you can unlock the full potential of custom node providers while maintaining a secure and private experience.

Solana: Error while testing code

Solana: Code Test Error

The Solana blockchain platform has been under close scrutiny recently, with several issues reported by users and developers. One of the most common errors is the “code test failed” or “code test error” that can occur when attempting to run the Solana program on the network.

In this article, we will address the Solana code test error issue and explore the possible causes and solutions.

The Problem

When running a Solana program on the network, the

testfunction is used to simulate a transaction or account operation. This function should return an error if something goes wrong during testing. However, for various reasons, this test function returns errors instead of correct results.This can happen for several reasons:

- Incorrect code

: The code being tested may contain syntax errors or logical errors that cause the program to fail.

- Dependency Issues: Dependencies on external libraries or packages may have compatibility issues or version conflicts, leading to failed tests.

- Account State Management: Account state management may be incorrect, leading to unexpected behavior during testing.

The Issue

The provided code snippet reports a “code test failed” error when attempting to run the program. The error message indicates that there was a problem with the test function, but no specific details are provided.

To diagnose this issue, let’s take a closer look at the code:

declare_id!("6u7Wzgps8X8Qjd5AaqaF5mpKdfZzSfNt2MaPjATf2Z6Y");

The

declare_idmacro is used to declare a persistent identifier that appears unrelated to the test function. This may indicate that there are other code issues or dependencies.Possible Solutions

To resolve this issue, several possible solutions can be explored:

- Check for incorrect syntax: Carefully review the code to ensure that it adheres to Solana syntax rules and best practices.

- Check account state management: Ensure that account state is managed correctly during testing.

- Update dependencies: Check for compatibility issues or version conflicts with external libraries or packages.

- Recompile the code: Try recompiling the program to see if a fix can be applied.

Best Practices

To minimize bugs and ensure smooth development, follow these best practices:

- Test thoroughly: Test your code thoroughly before deploying it to the web.

- Document dependencies: Clearly document any external libraries or packages used in your code.

- Use version control: Use version control systems like Git to track changes and collaborate with others.

By following these steps and being aware of common pitfalls, developers can increase their chances of resolving bugs while testing Solana programs on the web.

- Incorrect code