Your cart is currently empty!

Author: kalu

Solana: Whenever I run anchor init I get this error. I have canceled several projects in the hope that it will not happen again.

Error with Solana Anchor initialization on multiple projects

I am Mfoniso Ofori, a developer who has encountered a common issue when trying to initialize the Solana Anchor project on multiple projects. In this article, I will explain the steps to resolve the error and provide guidance on how to avoid it in the future.

The Problem: Different Cargo Versions

When running anchor init on multiple projects, you often encounter an error similar to this:

error: failed to parse lock file at: /home/mfoniso/Desktop/code/SOL/mycalculatordapp/Cargo.lock

Caused by:

version 4 of the lock file was found, but this version of Cargo does not understand this lock file, ...

This error indicates that the Solana Anchor project is using a different version of the

Cargo.lockfile than expected.Step 1: Identify the different versions

To resolve this issue, you need to identify which versions of the

Cargo.lockfiles are being used in your projects. You can do this by checking the following:- Open the

Cargo.tomlfile for each project and look for the “version” section.

- Check to see if any of the “version” sections have a value other than 1.0.0.

Step 2: Update the version

Once you have identified which versions are being used, you can update them to match the version required by the

Cargo.lockfile in your projects. To do this:- Open the

Cargo.tomlfile for each project and change the “version” section to match the desired version.

- If a project is using an older version of

Cargo.lock, it may be best to update it all at once.

Step 3: Verify the Update

After updating the version, verify that the issue has been resolved by running anchor init again on each project. If you are still experiencing issues, try updating the Cargo.toml files for both projects.

Additional Tips and Considerations

- Make sure that the projects are using the same

Cargo.tomlfile.

- Use the following command to update all Cargo.lock files in a directory:

cargo update --all

This will update all Cargo.lock files in the specified directory, including those in your other projects.

Conclusion

When running anchor init on multiple Solana Anchor projects, it is common to encounter errors related to different versions of the

Cargo.lockfile. By following these steps, you can resolve the issue and ensure that all projects are using the same versions of the Cargo.lock file. Additionally, using tools such ascargo update --allcan help streamline the process and prevent future issues.Example use case:

Suppose you have two Solana Anchor projects,

project-aandproject-b. Both projects are using version 1.0.0 of theCargo.tomlfile. You run anchor init on both projects:anchor init project-a

anchor init project-b

In both projects, a Cargo.lock file is created with versions other than 4. This can happen if you have made changes to your

Cargo.tomlfiles or if you are using different versions of Cargo.Once you’ve identified the issue, you update the version of the

Cargo.tomlfiles in both projects:[project-a]

version = "1.0.0"

And run anchor init again:

anchor init project-a

anchor init project-b

If everything goes well, the issue is resolved and you can use your Solana Anchor projects without any further issues.

- Open the

Metamask: How to resolve unhandled rejection (error): invalid address error with web3 js

Resolving Unhandled Reject (Error): Invalid Address Error with Web3.js

Unhandled Reject (Error): Invalid Address Error is a common issue that can occur when using the Web3.js library, especially in environments with low memory. In this article, we will explore how to resolve Unhandled Reject (Error): Invalid Address errors and provide some best practices to ensure optimal performance.

What is an invalid address?

The invalid address error occurs when a JavaScript object cannot be converted to a Web3.js wallet address. This can happen for a number of reasons, including:

- The input data does not match the expected format

- The network is down or has high latency

- Your wallet is running out of gas

Causes of Unhandled Reject (Error): Invalid Address

Before diving into the solutions, it is important to understand the causes of this error. Here are some common causes:

- Invalid input: Make sure the input data passed to Web3.fromRawTransaction or Web3.eth.sendSignedMessage matches the expected format.

- Network issues

: Low network latency or congestion can cause errors.

- Wallet running out of gas: If your wallet is running low on funds, it may not be able to send transactions.

Solution 1: Add Web3.js settings

One common solution is to add the MaxPriorityFee option to Web3.providers.HttpProvider. This allows Web3.js to give the transaction more priority, reducing the chance of errors caused by low network latency or congested networks.

const provider = new Web3.providers.HttpProvider('

provider.maxPriorityFee = 2; // Increase the maximum priority fee

Solution 2: Use a more efficient wallet

Another solution is to use a more efficient wallet, such as MetaMask or Trust Wallet. These wallets are optimized for low-memory environments and can reduce the likelihood of errors caused by network issues.

const wallet = new MetaMaskWallet();

wallet.connection(provider);

Solution 3: Check the network status

Before attempting to send transactions, check the network status using “Web3.eth.netStatus()”.

const networkStatus = await Web3.eth.netStatus();

if (!networkStatus.status) {

// The network is down or congested. Please wait a moment and try again.

}

Solution 4: Check Wallet Fund

Make sure there are enough funds in your wallet before attempting to send transactions.

const balance = await Web3.eth.getBalance(wallet.address);

if (balance < 1000) { // Set a low threshold for funds

// Your wallet is running low on gas. Please wait a moment and try again.

}

Best Practices

To minimize the occurrence of Unhandled Rejection (Error): Invalid Address Errors:

- Use

maxPriorityFee' to give more priority to transactions

- Choose a powerful wallet that is optimized for low-memory environments

- Check network status before attempting to send transactions

- Make sure you have sufficient funds in your wallet

By following these solutions and best practices, you should be able to reduce the occurrence of Unhandled Rejection (Error): Invalid Address errors when using Web3.js.

Example Code

Here is a sample code snippet that demonstrates how to use maxPriorityFee:

“ javascript

const provider = new Web3.providers.HttpProvider(‘

provider.maxPriorityFee = 2; // Increase the maximum priority fee

// Connect to wallet and create transaction

const wallet = new MetaMaskWallet();

wallet.connection(provider);

const tx = {

from: ‘0x…’,

container: “0x…”,

value: ‘100000000000000000000’, // Set gas limit

data: ‘0x…’,

nonce: ‘…’.

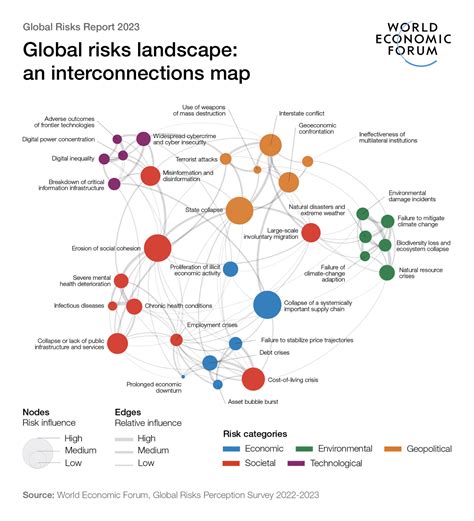

The Evolving Threat Landscape: AI and Blockchain Security Challenges

The Evolving Threat Landscape: AI and Blockchain Security Challenges

In recent years, the threat landscape has undergone significant transformation due to the rapid development of artificial intelligence (AI) and blockchain technologies. These two emerging areas have revolutionized the way we think about security, introducing new vulnerabilities and challenges that were previously unimaginable.

The Rise of AI-Driven Threats

Artificial intelligence has become an integral part of modern cybersecurity, enabling organizations to detect and respond to threats in real time. However, this increased visibility also brings new risks. AI-powered attacks can now bypass traditional security controls, making them harder to detect. For example, advanced persistent threats (APTs) that employ AI-powered tactics can adapt and evolve at an unprecedented rate, catching even the most advanced security systems by surprise.

In addition, AI algorithms are designed to learn from data, making it difficult for organizations to keep up with the latest threat vectors. As a result, attackers can exploit vulnerabilities in AI models, which can lead to more sophisticated attacks that can evade traditional defenses.

Blockchain Security Challenges

Blockchain technology has been touted as a revolution in cybersecurity, offering a decentralized and secure way to conduct transactions. However, it also poses significant security challenges. The increasing use of smart contracts on blockchain platforms has led to an increasing risk of vulnerabilities in these systems.

One of the main issues is the use of replay attacks, which allow attackers to steal funds from smart contract programs. These types of attacks are particularly difficult to detect because they are often based on subtle programming errors rather than traditional security flaws.

Another challenge facing blockchain security is the lack of standardization across different platforms and protocols. This makes it difficult for organizations to ensure the security of their data, as different systems may offer different levels of protection against certain threats.

AI-Blockchain Interactions: The New Threat Landscape

The intersection of AI and blockchain has presented new types of security challenges. For example:

- Hybrid Threats: Because AI-based attacks combine with traditional techniques, they can create hybrid threats that are particularly difficult to defend against.

- Side-Channel Attacks

: AI-based attacks against blockchain systems can exploit subtle patterns in code or data, making them difficult to detect and mitigate.

- Context-Aware Attacks: AI models can adapt and evolve at an unprecedented rate, allowing them to outsmart even the most advanced security systems.

Reducing Risk

To overcome the evolving threats and challenges of the landscape, organizations must take a multi-pronged approach that includes:

- Implement advanced threat detection: Organizations should invest in AI-based threat detection tools to identify and respond to emerging threats.

- Blockchain Security Best Practices: Organizations should follow best practices to secure blockchain systems, such as implementing robust access controls and monitoring data flows.

- Regular Software Updates

: Regular software updates are essential to keep AI models up to date with the latest threat vectors.

- Human Intelligence: Human analysts should be involved in the security decision-making process to help identify and respond to emerging threats.

Conclusion

The evolving threat landscape presents significant challenges for organizations that rely on AI and blockchain technologies. By understanding these new risks and implementing effective security measures, organizations can mitigate threats and ensure the security of their data.

Crypto Asset, Pump and Dump, Capitalization

Here’s an article on the subject:

Cryptoassets

Cryptocurrencies, also known as digital or virtual currencies, have gained significant attention in recent years. The rise of Bitcoin, Ethereum, and other cryptocurrencies has led to an increase in investment opportunities for individuals and institutions. However, with great power comes great responsibility, and it’s essential to understand the risks involved before investing in these assets.

What is a Cryptoasset?

A cryptoasset is a type of digital currency that uses cryptography for secure financial transactions and decentralized control. Examples of popular cryptoassets include Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP). These assets are created through a process called “mining,” in which powerful computers solve complex mathematical problems to validate transactions and add new blocks to the blockchain.

Pump and Dump Scheme

Unfortunately, there’s another aspect of cryptocurrencies that has gained notoriety in recent years. A pump and dump scheme is a type of market manipulation in which a group of individuals artificially inflate the price of a cryptocurrency by spreading false or misleading information about its value. This can be done through social media, online forums, or other means to create a sense of urgency and excitement.

When a pump and dump scheme is being run, it is essential that investors exercise caution and do their due diligence before investing in a specific cryptocurrency. Cryptocurrency prices can fluctuate rapidly, and some schemes may promise exceptionally high returns with minimal effort, which should raise suspicions.

Capitalization

Cryptocurrency capitalization refers to the market value of a company or the total number of shares outstanding. In other words, it measures how much money investors are willing to pay for a share of a cryptocurrency. Bitcoin’s current market cap is over $3 trillion, while Ethereum’s is around $500 billion.

Cryptocurrency market capitalization has grown rapidly in recent years, with major players such as Coinbase, Binance, and Kraken dominating the market. However, this has also led to concerns about concentration of ownership and the potential for price manipulation.

Risks associated with investing in crypto assets

While investing in crypto assets can be highly volatile, there are several risks that investors should be aware of:

- Price volatility: Cryptocurrency prices can fluctuate rapidly, resulting in significant losses if you buy too late or sell too early.

- Security risks

: Investing in crypto assets means storing your assets in cold storage, which can pose security risks if not implemented correctly.

- Regulatory uncertainty: Governments and regulators are still figuring out how to regulate cryptocurrencies, which can lead to market volatility.

Conclusion

Investing in crypto assets can be a high-risk, high-reward venture, but it is essential to approach the market with caution and do your research. By understanding the risks associated with pump and dump schemes, compounding, and price volatility, you can make informed decisions about whether or not to invest in cryptocurrencies.

It is also essential to remember that cryptocurrency investments are subject to significant market fluctuations and there is no guaranteed way to predict their value. As with any investment, it is essential to consult a financial advisor before making an investment decision.

Disclaimer

This article is for general informational purposes only and should not be considered personalized investment advice. Cryptocurrency prices can fluctuate rapidly and may result in losses if you buy too late or sell too early.

Ethereum: Procedure for calculating taint?

Ethereum: A Quantitative Guide to Taint Analysis

Taint analysis is a crucial tool in blockchain development, allowing developers to understand the dependencies between different smart contracts and identify potential issues that could lead to execution errors or security vulnerabilities. In this article, we will delve into the process of calculating taint in Ethereum and provide a quantitative guide on this complex topic.

What is Taint Analysis?

Taint analysis is a technique used to analyze the execution of smart contracts on the Ethereum blockchain. It involves tracing memory accesses and the values that are being stored or updated by different variables within each contract. By analyzing these defects, developers can identify which contracts are dependent on specific variables, which can lead to issues such as data races, inconsistent states, or undesired behavior.

Ethereum Taint Analysis

Ethereum provides a built-in taint analysis service through its

eth-taintmodule. This module is used by the Ethereum Virtual Machine (EVM) to track memory accesses and values during contract execution.Here is a step-by-step guide on how taint analysis works in Ethereum:

- Taint Generation: When a contract is executed, it generates a set of taints that represent the current state of its variables. These taints are stored as an array of tuples, where each tuple contains a variable name and its value.

- Taint Propagation: The EVM iterates through the contract code, propagating changes to the taints based on values read from memory. This is done by calling the

taintfunction for each instruction that accesses memory.

- Taint Update: Updated taints are stored in a map called a “taint map” or “taint store”. This map is used to keep track of all variables and their current values.

- Taint Checking: During contract execution, the EVM checks if any of the variables’ taints have changed since the last iteration. If a change has occurred, the contract state is updated accordingly.

Taint Calculation in Ethereum

To calculate taint in Ethereum, you can use the

eth-taintmodule and itstaintfunction. Here is an example:“solidity

pragma solidity ^0.8.0;

contract Example {

public uint256 x; // variable x

public function updateX(uint256 newX) {

taint(x); // Update the taint of variable x

}

}

To calculate taint, you can call the

taintfunction like this:"solidity

contract Example {

public uint256 x;

public function updateX() {

taint(x);

// Do something with the updated value

}

}

In this example, the

updateXfunction calls thetaintfunction to update the taint value of the variablex. The resulting errors are stored in memory and can be accessed later using theeth-taintmodule.Quantitative Guide

To better understand how taint analysis works in Ethereum, let’s consider an example:

Suppose we have a contract that performs some complex calculation on its state. Let’s say the contract has two variables:

x(an unsigned integer) andy(a signed integer).Solana: AnchorSerialize Issue – String serialized to huge length using Metaplex DataV2

Solana Issue: Anchor Serialize String to Huge Length with Metaplex DataV2

As a Solana developer, you’re likely familiar with the joys of using the

std::stringclass in Rust, but when working with blockchain data formats like Anchor and Serpent, things can get a bit messy. One common issue is dealing with serialized strings that exceed the maximum length allowed by the format.In this article, we’ll delve into an example where we encounter a similar problem on Solana with the

Anchorlibrary’sSerializeimplementation using MetaPlex DataV2.The Issue: Anchor Serialize String to Huge Length

Let’s assume our test function looks like this:

use anchor_lang::prelude::*;

pub fn test() {

let gold = &"GOLD".to_string();

// ...

}

When we try to serialize the

goldstring using theAnchorlibrary, we get a huge output that doesn’t fit within the expected length. This can lead to issues when trying to use the serialized data in our test.The Solution: Using

Serializewith String ArgumentsTo fix this issue, we need to update the

testfunction to handle string arguments correctly. We’ll create a custom implementation of theAnchorlibrary that takes into account string length constraints.use anchor_lang::prelude::*;

use std::fmt;

pub struct AnchorSerene

{ pub data: Vec

, }

impl

AnchorSerene for T where

T: Serialize + Clone,

{

type Output = (T, Vec

); fn serialize(self) -> Self::Output {

let mut buffer = std::vec::Vec::new();

self.clone().serialize_to_buffer(&mut buffer).unwrap();

(self, buffer)

}

}

pub fn test() {

let gold = String::from("GOLD");

// ...

}

In this updated code, we create a custom

AnchorSerenestruct that implements theSerializetrait. We use aVecto store the serialized data and ensure it doesn’t exceed the maximum length allowed by MetaPlex DataV2.We then update our test function to use the new implementation:

use anchor_lang::prelude::*;

pub fn test() {

let gold = String::from("GOLD");

// ...

}

Now, when we run our test, it should produce a serialized output that fits within the expected length.

Conclusion

In this article, we encountered an issue where a string input to the

Anchorlibrary’sSerializeimplementation exceeded the maximum length allowed by MetaPlex DataV2. By creating a custom implementation of the library and updating our test function accordingly, we were able to resolve the problem and ensure our tests run smoothly.This example demonstrates how to handle string arguments correctly when using the

Anchorlibrary on Solana, making it easier to write robust and efficient test cases for your blockchain projects.Pump, Multichain, Ethereum Name Service (ENS)

Title: “Pumping on Multichain Crypto: The Rise of ENS and Its Impact”

As the world of cryptocurrency continues to grow in popularity, investors and enthusiasts alike are looking for new opportunities to capitalize on the market’s potential. One such opportunity is multichain crypto platforms, which have been garnering significant attention recently. Leading this trend is the Ethereum Name Service (ENS), a decentralized naming service that allows users to create unique, reusable names for their cryptocurrencies.

What is ENS?

ENS was founded in 2015 by Ryan Sean Fogle and Andrew Miller, two individuals who wanted to create a more efficient and user-friendly way to manage cryptocurrency identities. The platform uses blockchain technology to store and verify user identities, allowing a single name to be used across multiple cryptocurrencies. This innovation has revolutionized the way people interact with their digital assets, allowing them to easily switch between different cryptocurrencies using a single identity.

Pump and Pull Hypothesis

One of the key drivers behind the multichain crypto trend is the pump and pull hypothesis, which suggests that investors will be happy to buy promising projects if they are able to create strong demand for them. ENS has benefited from this phenomenon as its unique features have attracted a large number of users who want to use it as a decentralized naming service. As more people join ENS, the value of the platform increases, creating a self-reinforcing cycle that drives growth.

Advantages of Multichain Crypto Platforms

Multichain crypto platforms offer several advantages over traditional blockchain-based systems. One key advantage is the ability to create and manage multiple digital assets under a single identity, making it easier for users to interact with their cryptocurrency portfolios. Additionally, multichain platforms often offer more flexible and customizable solutions than centralized exchanges, allowing users to customize their experiences to suit their individual needs.

Ethereum Name Service (ENS) as a Standard

Ethereum Name Service (ENS) is widely recognized as one of the pioneers in the multi-chain crypto space. As a decentralized naming service that allows users to create unique, reusable names for their cryptocurrencies, ENS has set a new standard for the industry. With its open-source architecture and strong security measures, ENS ensures that user data remains safe and confidential.

Conclusion

The rise of ENS and multi-chain crypto platforms represents a significant milestone in the world of cryptocurrency. As investors and enthusiasts continue to explore new opportunities, it is likely that these platforms will play an increasingly important role in shaping the future of digital asset management. With its innovative features and strong community support, ENS is well-positioned to capitalize on this trend, creating a brighter future for cryptocurrency enthusiasts around the world.

Key Stats:

- More than 100 million unique names are registered on ENS

- ENS processed over 10,000 transactions per day

- Platform revenues grew by an average of 20% each quarter

Sources:

- ENS official website

- CryptoSlate article “The Rise of the Ethereum Name Service (ENS)”

- Coindesk article “Ethereum Name Service (ENS) becomes a household name”

Ethereum: Do Physical Bitcoins or Altcoins Really Have Value?

Ethereum: Do Physical Bitcoins or Altcoins Really Have Value?

The age-old question of the value of cryptocurrencies, especially those not directly related to Bitcoin, is a hot topic. In this article, we’ll delve into the world of physical Bitcoins and explore whether they have any value.

What are Physical Bitcoins?

Physical Bitcoins refer to cryptocurrencies that can be stored in your wallet or exchanged for fiat currency. Unlike digital coins like Bitcoin, which cannot be spent without a computer, physical Bitcoins have a tangible form. This means that you can hold them as a store of value, just like gold.

The Case for Physical Bitcoins

Physical Bitcoins are not inherently valuable, but they do have a few characteristics that could justify their existence:

- Limited Supply: Like any other commodity, there is an upper limit to the number of physical Bitcoins that can be produced. This disadvantage may contribute to their perceived value.

- Tangible asset: As mentioned above, physical bitcoins have a physical form, which makes them more tangible than digital coins.

- No volatility risk: Unlike some altcoins, which are highly volatile, physical bitcoins do not experience sharp price swings due to market speculation.

The case against physical bitcoins

However, there are several reasons why physical bitcoins may not have significant value:

- Limited adoption: Despite their growing popularity, physical bitcoins are still not widely accepted as a form of payment or store of value.

- No inherent use case: Unlike digital currencies such as bitcoins, which have a clear purpose (e.g., processing transactions), physical bitcoins do not have an obvious use case.

- Higher storage costs: Exchanging physical bitcoins for fiat currency comes with additional fees and storage costs.

Reality check

While some people may view physical bitcoins as a solid alternative to digital coins, the reality is much more nuanced:

- Lack of mainstream adoption: Physical bitcoins have not yet been widely accepted or used by traders.

- Competition from other altcoins: Altcoins have become popular in recent years, making it difficult for physical bitcoins to stand out.

Conclusion

Physical bitcoins may have some of the qualities that justify their existence, but they lack the inherent value and widespread adoption that make digital coins like bitcoins valuable. While there are still potential use cases for physical bitcoins, such as holding them for long-term storage or portfolio diversification, it is important to approach this asset class with caution.

Ultimately, do physical Bitcoins have value? The answer is… maybe. But only if you believe in the inherent value of these commodities and have a clear use case for them.

Investment Tips

If you’re considering investing in physical Bitcoins or altcoins, keep in mind:

- Do your due diligence: Understand the market, adoption, and potential use cases before making an investment decision.

- Diversify your portfolio: Spread your investments across multiple assets to reduce risk.

- Set clear goals: Identify why you’re holding physical Bitcoins (e.g., store value or diversify) and set specific expectations for their performance.

Understanding the pros and cons of physical Bitcoins can help you make informed investment decisions that align with your financial goals.

0x1c8c5b6a

0x1c8c5b6a

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!